Difference Between Carbon Tax And Cap And Trade

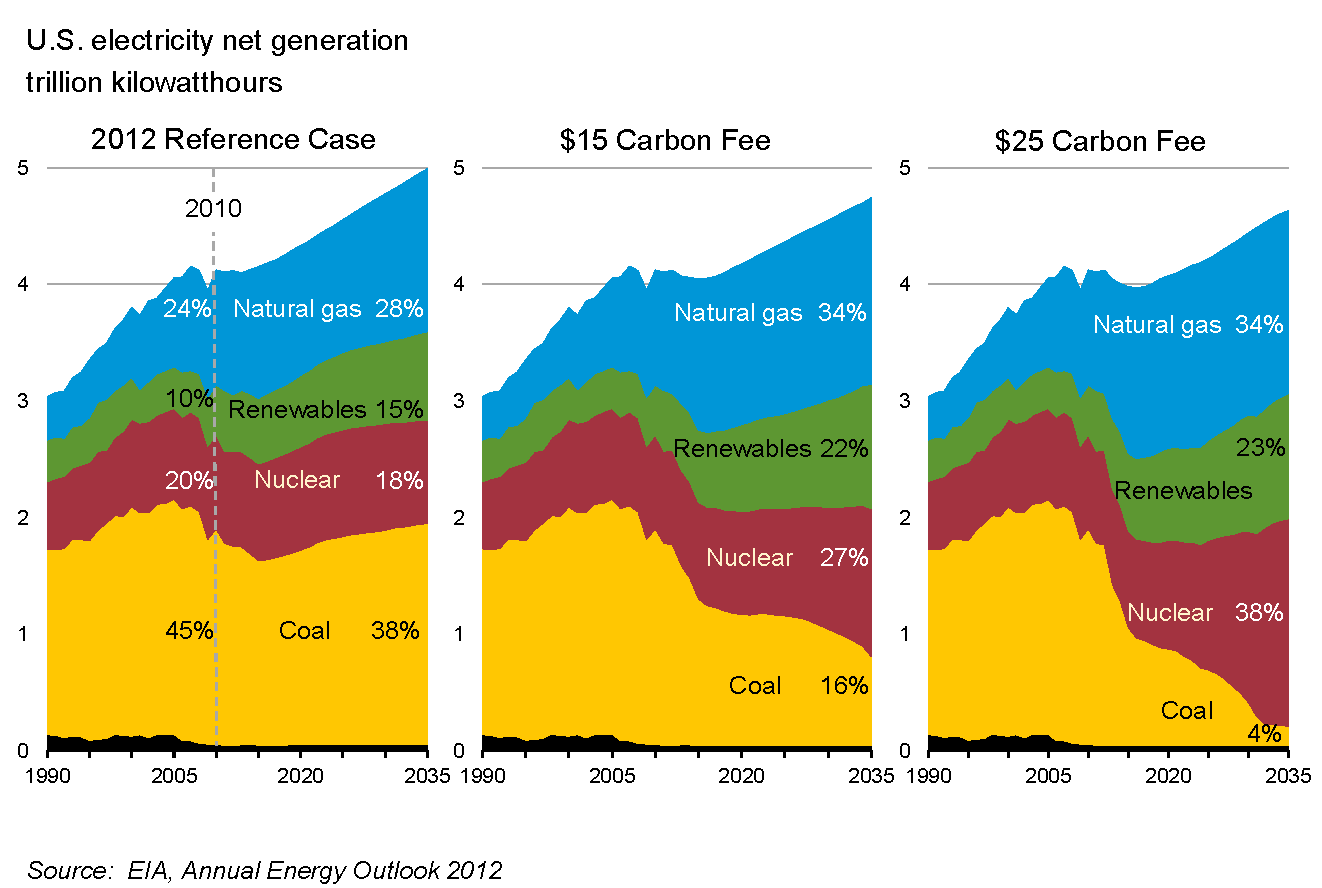

While today there is a great emphasis on renewable and clean energies, fossil fuels are still largely used in the industrial sector and continue to represent the cause of greenhouse emissions and pollution. Governments across the world have implemented a number of strategies to reduce pollution and tackle climate change. The two key strategies used to reduce carbon emissions are the carbon tax and the cap-and-trade strategy. In the first case, governments charge a fee on companies and households that employ fossil fuels, encouraging them to invest in cleaner technologies. In a cap-and-trade system, governments impose a cap – which decreases every year – on the overall level of carbon pollution in the industry. Polluters that exceed their allocated quota can purchase unused quotas from other companies. Both strategies have proved effective and both systems tackle a real problem in today’s world, pushing for the use of cleaner and renewable energies and for the reduction of greenhouse gases.

What is the Carbon Tax?

A carbon tax is a fee imposed to firms and households in some cases aimed at reducing greenhouse emissions. The tax applies to each unit of greenhouse gas emissions and is set by assessing the damage linked to each unit of pollution as well as the cost associated with controlling and assessing that pollution. By having to pay a tax, firms are encouraged to reduce emissions and to opt for cleaner types of energies. Finding the right level for the carbon tax is key: if the tax is too high, it could affect the country’s economy, impacting jobs and profits, while if it is too low it would not be a strong enough inventive for firms to reduce emissions. At the same time, a high tax is more likely to push firms and households to look for alternative – and cleaner – sources of energy, increasing at the same time mass-consumers’ demand for cleaner products.

What is Cap-And-Trade?

A cap-and-trade system is an alternative to carbon tax to reduce greenhouse emissions. This system sets a maximum cap on pollution, and distributes emissions quotas or permits among polluters (mainly large firms). Permits are obtained through an initial auction or allocation, and firms must have a permit for each unit of emission they create. Quotas can also be traded with other firms, meaning that heavy polluters can purchase additional permits from firms that are able to reduce their environmental impact more quickly. In this scenario, market fundamentals (supply and demand) determine the price of permits, meaning that when there is little supply and high demand the price of polluting increases exponentially. In a cap-and-trade system, the limit on pollution is gradually decreased each year.

Similarities Between Carbon Tax and Cap-and-Trade

The carbon tax and the cap-and-trade system are two effective systems to reduce greenhouse emissions and promote the use of clean and renewable energies. While there are some differences between the two, carbon tax and cap-and-trade system have a number of aspects in common and can even be complementary. Some of the key similarities between the two are listed below:

- Both address a key social and environmental issue by putting a price on carbon: Cutting greenhouse emissions by reducing the use of fossil fuels is the main purpose of both the carbon tax and the cap-and-trade system. Both strategies have been formulated as a response to climate change and pollution;

- Both generate revenue for the government: In the case of the carbon tax, the government generates venue by applying a fee on each unit of greenhouse emissions generated by a firm, while in a cap-and-trade system money is raised through auctions and quotas trading. The amount of money raised is fixed in the case of the carbon tax, while it varies depending on firms’ performance in the a cap-and-trade system; and

- Both target a limited amount of firms and households: Both the carbon tax and the cap-and-trade system aim at reducing greenhouse emissions by targeting the largest polluters in the industry. Therefore, restrictions apply to large firms and companies, while individual households are less affected.

What is the Difference Between Carbon Tax and Cap-and-Trade?

The carbon tax and the cap-and-trade system are two ways in which the government tackles pollution and attempts to reduce greenhouse emissions. It is generally believed that a tax system is simpler and more effective, but the evidence suggests that a mixed system often yields better results. Combining the tax and the cap-and-trade systems is the preferred option by some governments as the tax ensures a fixed stream of revenue, while cap-and-trade ensure the achievement of environmental goals.

Some of the key differences between carbon tax and cap-and-trade are listed below:

- Revenue vs environment: While both carbon tax and cap-and-trade system aim at reducing greenhouse emissions, they use a different approach and yield slightly different results. In the case of the carbon tax, there is a fixed revenue – as firms are expected to pay the tax on each unit of emissions – while the level of pollution is determined by market forces as there is no actual limit on emissions. Conversely, in the case of a cap-and-trade system, a limited on emissions is imposed by the government, but there is no fixed revenue as the price of permits and quotas is determined by market fundamentals (supply and demand); and

- Role of the firm: In both cases, firms and households enjoy a certain flexibility. In the case of the carbon tax, firms can decide how much they are willing to pay and reduce or regulate their emissions accordingly. Some firms may decide that paying a carbon tax is economically more convenient than reducing emissions, while – in the case of a cap-and-trade system – firms may decide to trade the majority of their quotas or to take advantage of market trends to get higher returns for their unused emissions’ permits.

Carbon Tax vs Cap-and-Trade

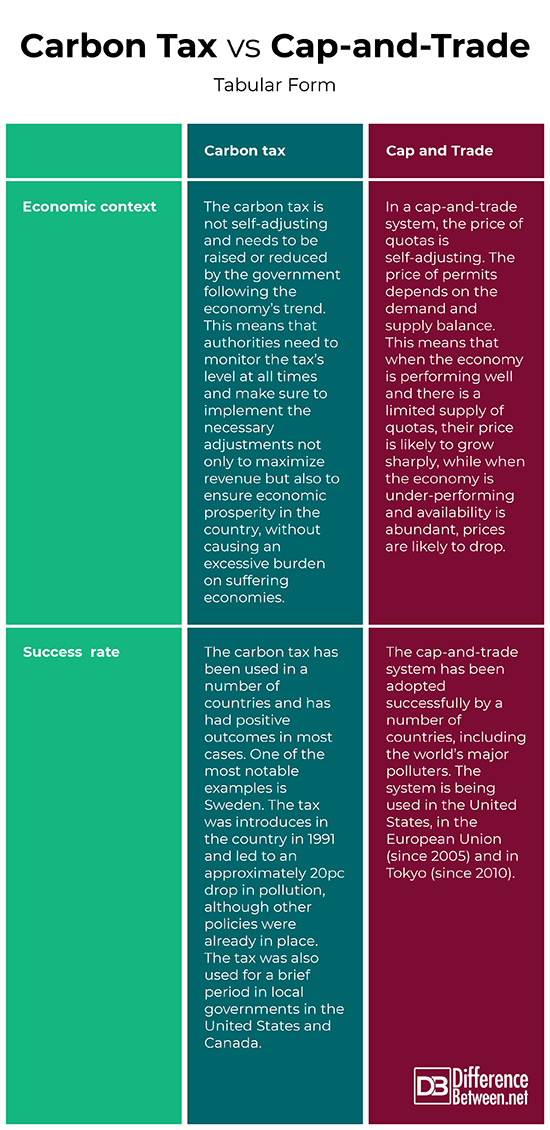

The impact of the carbon tax and cap-and-trade on a country’s economy is significant. At the same time, the economy’s performance affects the way in which firms comply with their obligations. The carbon tax and the cap-and-trade system cannot be understood without analyzing them within a broader context and without evaluating their success rate.

Carbon Tax vs Cap-and-Trade: Tabular Form

Summary of Carbon Tax vs Cap-and-Trade

Reducing greenhouse emissions and tackling climate change is a priority for most governments. These goals can be achieved by implementing a number of policies and educating societies and businesses.

Two of the key policies chosen by governments are the carbon tax and the cap-and-trade system. In the case of the carbon tax, firms and households have to pay a pre-determined amount of money per each unit of greenhouse emissions.

Conversely, in a cap-and-trade system firms are allocated a certain number of emissions quotas, which can be distribute through an initial auction.

Firms that use their entire allocation can purchase unused quotas by other companies, and the price of permits is determined by market fundamentals.

Both methods have proved effective in reducing emissions and promoting the use of cleaner and renewable energies.

Carbon tax is used by Sweden and was implemented in some local governments in Canada and the United States, while the cap-and-trade system is the preferred choice of the European Union, Tokyo and the United States.

In most cases, government implement mixed approaches and create a number of policies to tackle the issue in a comprehensive and effective manner.

- Difference Between Michelle Obama and Melania - January 29, 2019

- Difference Between Trump and Modi - December 4, 2018

- Difference Between Carbon Tax And Cap And Trade - December 4, 2018

Search DifferenceBetween.net :

Leave a Response

References :

[0]Image credit: https://upload.wikimedia.org/wikipedia/commons/thumb/3/3a/Eu_cap_and_trade_talk_page_alternatives.svg/500px-Eu_cap_and_trade_talk_page_alternatives.svg.png

[1]Image credit: https://commons.wikimedia.org/wiki/File:Estimated_Effect_of_Carbon_Tax_in_US.png

[2]Poterba, James M. Tax policy to combat global warming: on designing a carbon tax. No. w3649. National Bureau of Economic Research, 1991.

[3]Stavins, Robert N. "Addressing climate change with a comprehensive US cap-and-trade system." Oxford Review of Economic Policy (2008): 298-321.

[4]Ulph, Alistair, and David Ulph. "The optimal time path of a carbon tax." Oxford Economic Papers (1994): 857-868.