Difference Between SSDI and SS

Ever wonder what an SSDI is and who can get it? The United States Social Security Administration administers two of the largest disability programs in the country, and perhaps the world: the Social Security Disability Insurance (SSDI) program and the Supplemental Security Income (SSI) disability program. Both the programs were borne out of the original Social Security Act of 1935. But they are often confused with one another.

What is SSDI?

SSDI, short for “Social Security Disability Insurance,” is the United States government-funded federal insurance program that provides financial assistance to people with disabilities. Managed by the Social Security Administration, SSDI is an earned benefit that qualifies an individual who is working and paying Social Security taxes. This means workers and employers pay for the benefits with their Social Security taxes. Individuals must have worked in employment covered by Social Security for a specified time to be eligible for benefits.

To qualify for SSDI benefits you must meet two criteria: the first one is you must have worked enough in jobs covered by Social Security to reach disability-insured status, and the second rule is you have to meet the Social Security Administration’s definition of disability. The SSA has some pretty specific rules regarding disability, like your disability must be severe, long term, and limit your ability to work. The SSDI program was put into effect in 1956, more than two decades after the original Social Security Act.

What is SS?

Social Security is the very foundation of long-term financial support for almost every American. So, what is it exactly? Social Security is a program first initiated by President Franklin D. Roosevelt in 1935 and it was designed to provide financial assistance to support retirees and the elderly population. The Social Security Act of 1935 created the Social Security program as well as insurance against employment. Now, with some restrictions, 6.2% of an employee’s income plus another 6.2% tax on employers goes towards Social Security.

Social Security is like your financial support net that aims to protect against things that threaten your ability to survive financially, things like old age, retirement, serious injury or accident that leaves you unable to work. That’s why Social Security offers a range of benefits to provide financial security for workers, their immediate family members, and even divorced spouses. It is basically an insurance program where the workers pay towards the program through payroll withholding where they work.

Difference between SSDI and SS

Act

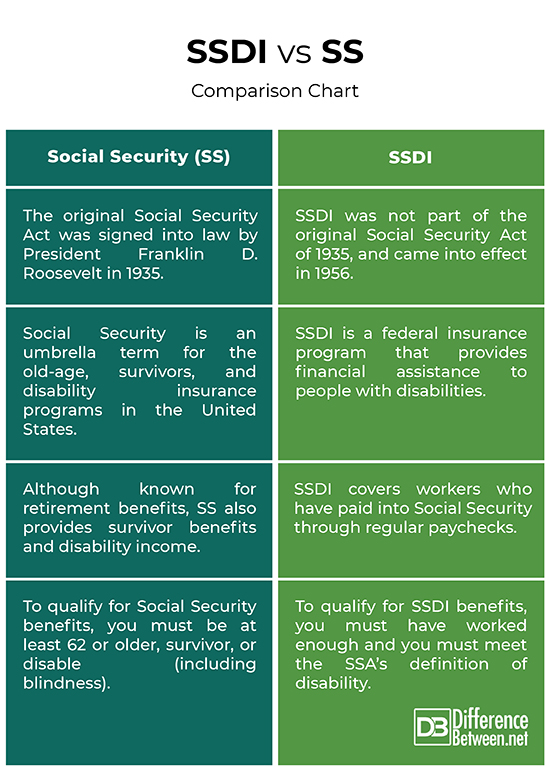

– The Social Security Act of 1935 created the Social Security program as well as insurance against employment. It was signed into law by then President Franklin D. Roosevelt. The law established the Social Security program. However, the SSDI was not part of the original Social Security Act. Rather, the SSDI program was put into effect in 1956, more than two decades after the original Social Security Act. Social Security is an umbrella term for the old-age, survivors, and disability insurance programs in the United States, run by the SSA.

Program

– The Social Security program is the very foundation of long-term financial support for almost every American. But it is more than just a retirement program. Social Security provides financial support against things that threaten your ability to survive financially, things like old age, retirement, serious injury or accident that leaves you unable to work. SSDI is a federal insurance program that provides financial assistance to people with disabilities.

Benefits

– It’s easy to get confused by them because their names are pretty similar and they are both run by the Social Security Administration. Social Security benefits are based on earnings and although it is known for retirement benefits, it also provides survivor benefits and disability income. SSDI is an earned benefit that qualifies an individual who is working and paying Social Security taxes. SSDI covers workers who have paid into Social Security through regular paychecks.

Eligibility

– To qualify for Social Security benefits, you must be at least 62 or older, survivor, or disable (including blindness). The benefits also go to family members. To qualify for SSDI benefits you must meet two criteria: the first one is you must have worked enough to reach disability-insured status, and the second rule is you have to meet the Social Security Administration’s definition of disability.

SSDI vs. SS: Comparison Chart

Summary

Social Security combines other distinctive features that you normally do not find all in one place. Remember, the benefits are based on earnings and to qualify for the benefits, you must be at least 62 years old or older and have paid towards the benefits for at least 10 years. The spouses and ex-spouses may also be entitled to avail benefits based on their partner’s earnings. The amount is based on your average lifetime earnings and the number of work credits earned. Social Security benefits are guaranteed and paid under legal formulas.

What pays more SSDI or Social Security?

The average monthly Social Security benefit was $1,543 in January 2021. Because the Social Security benefits are based on earnings, some recipients can receive more. Same goes for SSDI. The average SSDI payment is currently $1,277 per month.

At what age does SSDI convert to SS?

At the retirement age, when you reach 65 your Social Security disability benefits stop and convert into regular Social Security retirement benefits instead. Your disability benefits automatically convert to retirement benefits.

Can you get SSDI and Social Security?

In most cases, you cannot avail both Social Security retirement benefits and Social Security Disability Insurance benefits at the same time. However, you may qualify for Supplemental Security Income (SSI) if you fulfill some financial criteria.

How long does SSDI last?

SSDI benefits can last as long as you remain disabled or until you reach the age of 65. After 65, your disability benefits stop and automatically get converted into retirement benefits.

How much is SSDI a month?

SSDI monthly payments may range on average between $800 and $1,800. The maximum you could avail is over $3,000 per month.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Peterson, Jonathan. Social Security for Dummies. New Jersey, United States: John Wiley & Sons, 2016. Print

[1]Ditch, John. Introduction to Social Security: Policies, Benefits and Poverty. London, United Kingdom: Routledge, 1999. Print

[2]George, Victor. Social Security and Society. London, United Kingdom: Routledge, 2018. Print