Difference Between GDR and ADR

Global Depository Receipts (GDR) and American Depository Receipts (ADR) are mechanisms adopted by European and American companies to raise finances to expand their operations.

What is GDR?

Global Depository Receipt (GDR) is a negotiable instrument used by companies to raise funds to fund its operations as a single instrument. A depository bank is responsible for issuing the receipts representing the affixed number of shares in a foreign enterprise.

Any person holding a GDR receipt can convert the receipt into units of ownership (shares) by depositing the receipts to the bank.

What is ADR?

The American Depository Receipt (ADR) is a negotiable certificate, which is issued by a United States bank representing units of ownership (shares) of a foreign country, which is trading in the United States stock exchange market.

American Depository Receipts (ADR) is offered to the citizens of the United States who want to invest in non-US companies, upon which the dividends are paid in US dollars.

A holder of an ADR can easily transfer the receipt with its underlying shares and the associated benefits without any stamp duty.

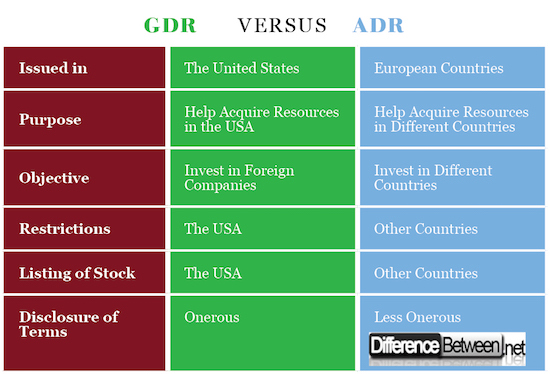

Difference Between Global Depository Receipts (GDR) and American Depository Receipts (ADR)

Meaning of GDR and ADR

The primary difference between ADR and GDR is that ADR is a depository receipt that is issued by an American bank representing a specific number of shares of a non-US enterprise wishing to raise investment money in the US stock exchange.

On the other hand, the GDR receipt is a negotiable instrument that is issued by an international depository institution or bank which represents a foreign corporation that is offering its shares to the global market, except the United States stock market.

Objective/Purpose of GDR and ADR

The objective of the American Depository Receipt is to help foreign companies to acquire finances by the sale of shares to the United States citizens. Besides, it offers investors in the United States to invest in foreign countries.

The purpose of the Global Depository Receipt (GDR) is to help international companies to seek financing of their operations from investors in different countries around the world. Additionally, investors can invest in companies in different parts of the world.

Trading Jurisdiction of GDR and ADR

Using the American Depository Receipt (ADR), the companies have the authority to trade in the United States market, hence offering shares to the US citizens who may wish to invest in foreign companies and receive their dividends in dollars.

However, the holders of the Global Depository Receipt (GDR) can only possess buy shares of the companies trading in the international markets, mostly the European countries but the cannot purchase shares of the companies selling in the united states.

Disclosure of Terms for GDR and ADR

The disclosure of all the requirements required for trading activities under the American Depository Receipts (ADR) is onerous. The Securities Exchange Commission (SEC) has placed onerous terms so that investors do not lose their cash.

This is not the same for the Global Depository Receipts (GDR) where the terms of trade and requirements are less onerous. This means that there is less control of the trading platform and investors are likely to lose their investments.

Listing of Stock of GDR and ADR

The American Depository Receipts (ADR) are listed on the American stock exchange. Therefore, an individual who wants to purchase ADR can access them from the New York Securities Exchange (NYSE) and the National Association of Security Dealers Automated Quotations (NASDAQ).

Global Depository Receipts (GDR) can only be acquired in other parts of the world expect the United States. Therefore, a person wishing to purchase GDR can buy them on the London Stock Exchange and the Luxembourg Stock Exchange among other security markets across Europe.

Restrictions in GDR and ADR

The American Depository Receipt (ADR) can only be negotiated and issued in the United States of America. Besides, all the transactions are quoted in dollars and investors are paid their dividends in US dollars.

The Global Deposit Receipt (GDR) is negotiated and issued in all parts of the world, except the United States of America. Moreover, the currency of transaction may change concerning the origin of the company offering its shares.

Difference Between GDR vs. ADR: Comparison Table

Summary of GDR vs. ADR

- ADR and GDR are financial instruments that are issued by companies to acquire resources to finance their services from investors in different parts of the world.

- ADRs are negotiated in the United States and can only be listed and acquired in the US and are denoted by the United States Dollars.

- GDRs are negotiated, issued, and listed in different parts of the world except for the United States stock exchange market.

- The purpose of ADRs is to help individuals to invest in companies foreign countries while ADRs allows businesses to seek resources from investors in different countries, especially the European countries.

- Difference Between Gross NPA and Net NPA - April 20, 2018

- Difference Between Job Description and Job Specification - April 13, 2018

- Difference Between Yoga and Power Yoga - April 10, 2018

Search DifferenceBetween.net :

1 Comment

Leave a Response

References :

[0]Choi, Yoon K., and Dong-soon Kim. "Determinants of American depositary receipts and their underlying stock returns: implications for international diversification." International Review of Financial Analysis 9.4 (2000): 351-368.

[1]Doidge, Craig, G. Andrew Karolyi, and René M. Stulz. "Has New York become less competitivethan London in global markets? Evaluating foreign listing choices over time." Journal of Financial Economics 91.3 (2009): 253-277.

[2]Karolyi, G. Andrew. "The role of American Depositary Receipts in the development of emerging equity markets." Review of Economics and Statistics 86.3 (2004): 670-690.

[3]Image credit: https://en.wikipedia.org/wiki/Security_(finance)#/media/File:1969_$100K_Treasury_Bill_(front).jpg

[4]Iamge credit: https://upload.wikimedia.org/wikipedia/commons/e/e3/Gold_price_in_USD.png

Hi,

thank you for the great post explaining the difference GDR and ADR.

I was just wondering on the picture: 100,000 The USA treasury bill, issue date Oct 9, 1969 is it a ADR?