Difference Between Loans and Advances

Money is an essential aspect of any organization or business because it helps the entity to meet its responsibilities as and when they fall due. It is also essential for a company to have enough funds for investment purposes as well as competition with other entities in the same industry. Individuals also need money so that they can run their affairs smoothly. Since no person or organization has enough money to cater for their obligations, the deficit is provided for by the use of loans and advances.

What is a Loan?

A loan refers to the sum of money in form of a debt offered by a financial institution to another organization that is supposed to be paid on interest within a stipulated period. The terms of the loan are set in a loan contract form, and they usually include an amount to be repaid, repayment period, and interest among others.

What is an Advance?

Advances are amounts of money offered by an employer to an employee so that he or she can meet the financial obligations for a specific duration of time and they are usually deducted from the monthly salary. A business may also apply for an advance from a banking institution upon which the amount is paid within a year.

Difference Between Loans and Advances

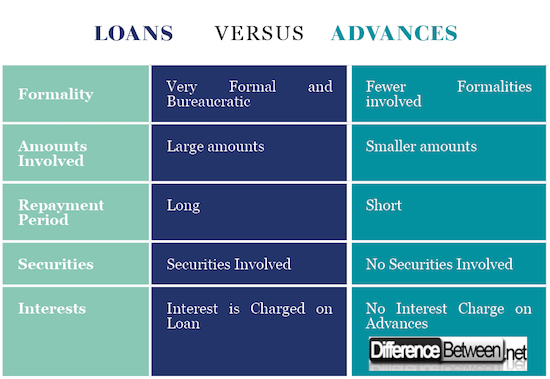

Formality of Loans and Advances

One of the primary difference between loans and advances is the formality involved when acquiring such money. Loans are usually very formal, and they include lengthy bureaucratic procedures before one can access the amounts. This is because a business or an individual has to be screened and vetted on how they will use the money and their ability to pay back the loans and interests. This is not the same for advances, and only a few bureaucracies are involved before one gets the money. Mostly, the only parties involved while applying for advances is the employee and the employer hence fewer formalities before one is given the cash he or she needs.

Amounts Involved in Loans and Advances

The amount of money that one needs usually vary between loans and advances. Loans involve acquiring vast sums of money while advances involve moderate to smaller values. It is important to highlight that a business might be receiving its initial capital in the form of loans so that it can start its operations. In such a scenario, huge amounts of money are required which may even amount to millions of dollars. Various multinational organizations fund their activities using large amounts of loans that they acquire from lenders and government institutions. However, advances are used to fund recurrent expenditure or to meet short-term goals, which mean the only small amount of money is needed for the immediate solution.

Payment Duration in Loans and Advances

The period it takes to pay loans and to pay for advances acquired from financial institutions significantly vary from one another. Although it depends on the agreement in the loan contract, loans take a larger period to be paid as compared to advances. Organizations have to get their investment to fully operate before they can start paying their loans, which are paid in installments either divided on the monthly or quarterly basis. A loan may even take more than ten years before it can be fully settled. On the other hand, advances involve the little amount of money that can be paid within one month or deducted from the salary of an individual. However, advances that are given to business entities by financial institutions are supposed to be paid within one year.

Interests in Loans and Advances

The other distinguishing factor is that loans accrue interests while advances to do accrue interests. Any individual or an organization that acquires a loan from a financial institution is required to pay a fee above the principle amount of loan, which is used to cover for the time value of money and the risk associated in giving such huge amounts of money. The interests amount is spread out within the repayment period and is calculated as a proportion of the principle amount borrowed. Advances do not attract interests because they are paid within a short period, which means that less risk is involved and there is no loss in the value of money.

Securities in Loans and Advances

When an organization or an individual is given a loan by a financial institution, he or she is required to deposit collateral, which acts as security for the loan granted. Individuals are asked to file their land ownership certificates, house ownership certificates, and car logbooks to act as securities for the loan given. In case of default, the security will be taken by the financial institution to cater for the loan. However, any individual who acquires an advance is not required to deposit security because his or her salary or the work being done already covers the loan.

Differences Between Loans and Advances

Summary of Loans vs. Advances

- Despite the significant number of differences that exist between loans and advances, it is important to note that the amount borrowed is used to spearhead operations in an organization for future growth.

- The amounts borrowed through loans are considered as debts while those borrowed through advances are considered as credit facilities because of the amounts involved and the repayment duration.

- It is necessary for borrowers to understand the distinction between loans and advances so that they can make sound decisions on what to borrow depending on their needs and the associated terms.

- Difference Between Gross NPA and Net NPA - April 20, 2018

- Difference Between Job Description and Job Specification - April 13, 2018

- Difference Between Yoga and Power Yoga - April 10, 2018

Search DifferenceBetween.net :

Leave a Response

References :

[0]Image Credit: http://www.picserver.org/p/personal-loan01.html

[1]Image Credit: https://www.flickr.com/photos/andrewbain/526463870

[2]Deloof, Marc. "Internal capital markets, bank borrowing, and financing constraints: evidence from Belgian firms." Journal of Business Finance & Accounting 25.7‐8 (1998): 945-968.

[3]Louis, Dimitrios P., Angelos T. Vouldis, and Vasilios L. Metaxas. "Macroeconomic and bank-specific determinants of non-performing loans in Greece: A comparative study of mortgage, business, and consumer loan portfolios." Journal of Banking & Finance 36.4 (2012): 1012-1027.

[4]Rajan, Rajiv, and Sarat C. Dhal. "Non-performing loans and terms of credit of public sector banks in India: An empirical assessment." Occasional Papers 24.3 (2003): 81-121.