Difference between Conceptual frameworks and Accounting Standards

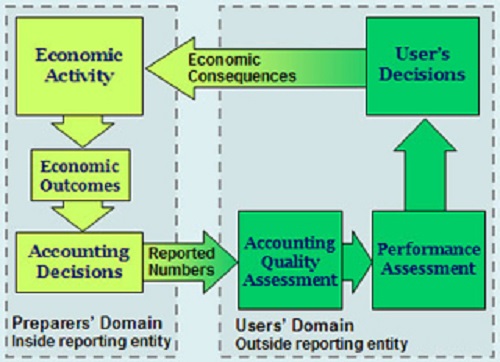

Conceptual Framework Diagram

Introduction

Financial reports and statements are an important entity which helps in running businesses and financial activities in the world. It would be right to say that financial reports are a must and commerce is dependent on financial reporting.

Due to the two financial reporting systems in the world, IFRS and GAAP, differences arise in the existence of terminologies. This article focuses on the conceptual frameworks and accounting standards, which are terms in accounting that help in the reporting of financial statements both in the IFRS and GAAP.

In this discussion, our focus shall be on the different ways in which both the conceptual frameworks and accounting standards function and exist. We shall look into their frameworks within the IFRS and GAAP, with an attempt to define the intricate placement of these two terms within the two-world financial reporting systems.

Definition of Terms

Accounting standards

These are statements that have been placed authoritatively to manage financial reporting. Accounting standards can be recognized as the chief source of what is accepted and regarded as accounting principles. Accounting standards dictate how various types of transactions and events should reflect in financial statements. These standards have been put to ensure that investors and all stakeholders- including lenders – are provided with financial information.

Accounting standards outline how transaction and all financial activities should be conducted, analyzed, and presented in financial statements. They are a component of the accounting framework, and they help accounting practitioners to make use of the accounting practices in the most advantageous way possible. Accounting standards are also important as they help companies and the managers to justify the practices they used to make financial statements-in case a loss was realized.

Accounting standards describe the problem that needs to be solved. They then provide a platform to discuss the best way to handle the problem, and finally describe the solution that is in tandem with the accounting practices.

Conceptual Framework

A conceptual framework for financial accounting is an accounting theory that is prepared by a body which sets standards. This body sets the standards to test problems that are practical, objectively. A conceptual framework plays a significant role in issues that concern financial reporting.

Key Differences

A conceptual framework is an entirely distinct entity from the accounting standards. Both functions have their purposes, advantages, and disadvantages. The two functions do not exist as a competing entity, but they have been defined to serve very different purposes. Their functioning is also independent of themselves and has the various frameworks in which they work in.

A financial accounting student would know that accounting standards are a supplemental pathway to allow the designing of better conceptual frameworks in preparing financial statements. On the other hand, it would be right to note that the existence of known conceptual frameworks nudges for the availability of sound accounting standards that function better in particular cases of financial accounting.

Benefits

A conceptual framework has the following benefits.

- It establishes definitions that are precise to help in discussing accounting issues.

- Conceptual frameworks guide those who set standards in accounting during the establishment and review of financial reporting regulations.

- Conceptual frameworks also help auditors to resolve financial reporting problems even when there are no standards for accounting.

- It also helps to limit the number of accounting standards through the provision of an umbrella theory of accounting, applied to problems in accounting.

On the other hand, accounting standards have different benefits from those of the conceptual framework.

- Accounting standards improve the credibility and reliability of financial statements.

- Accounting standards help to defend the decisions made by accountants and auditors, in the case when financial liability has been realized.

- Accounting standards also help to determine the accountability of the managerial office

- They help in reforming the accounting theory and practice.

A conceptual framework helps to boost the confidence of the people who use financial statements by increasing their understanding. On the other hand, the accounting standards’ main benefit to the users of financial statements is that they have helped in the obtaining of information that could have been hard to disclose by companies.

Financial Accounting Standards

Function

The function of accounting standards is to help encourage and champion the use of sound financial systems in the local sector while promoting financial solidity globally. These standards help to strengthen how finances are regulated and supervised, while at the same time increasing transparency.

Conceptual frameworks, on the other hand, function to assist in the formulation of future International Financial Reporting Standards. They also promote the harmonization of the regulations and the standards of accounting through the reduction of alternative financial accounting methods. The conceptual framework also serves to assist auditors and preparers of financial reports, in the application of IFRS.

(Accounting standards are meant to provide a way for sound financial reporting. Conceptual Frameworks function to help in implementing and using IFRS).

IFRS and GAAP

The difference in the two accounting systems that are internationally recognized has their contribution to accounting standards and conceptual frameworks. The GAAP is existent in the USA to serve and regulate financial reporting and disclosure in the US. The IFRS is recognized as the global pace setter that guides companies and business entities in a cohesive system that harmonizes financial reporting.

The conceptual framework resulted in offering guidance on how financial reports are prepared and disclosed. On the other hand, the accounting standards offer a threshold that must be met in when preparing and disclosing financial statements.

Therefore, when conceptual frameworks are meant to provide a navigation through financial reporting problems, accounting standards are clear methodologies that must be adhered to for presenting credible reports that are for consumption by a wide range of stakeholders. Conceptual frameworks rally behind the IFRS while accounting standards determine financial reporting in both IFRS and GAAP.

For conceptual frame works in IFRS, the entities are directed to consult and consider what conceptual framework is best in developing an accounting policy when there is no standard to follow. For the GAAP, the accounting standards provide a very determined course in which conceptual frameworks cannot be applied in specific accounting problems.

Reliability

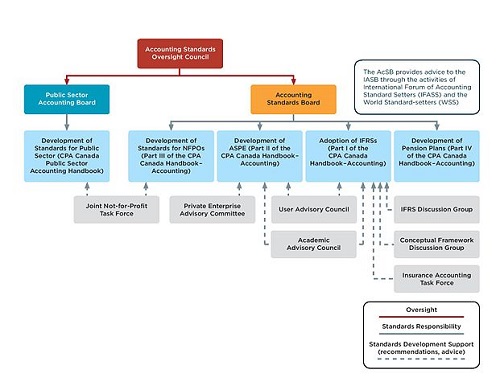

Accounting standards are termed as a point of reference available for application in many places all around the world. As an example, the Accounting Standards in U.k are agreed upon by the U.K IAS and are employed for use all through the U.K.

On the other hand, conceptual frameworks have more constraints in their applications.

- Financial statements are used by many people such that, no single conceptual framework can help to meet their financial accounting needs.

- Conceptual frameworks can only be employed after a consensus has been reached. It would be hard to reach a consensus on the best conceptual framework that a whole nation should use.

Flexibility

Unlike the conceptual frameworks that can be put to use after a consensus is reached, accounting standards are disadvantaged in flexibility.

- Accounting standards will only allow one method to be used for preparing accounts. While this may promote uniformity in reporting, it may be inappropriate in some circumstances. The inflexibility results to the rigidity phenomenon that is associated with accounting practices. The accounting standards are also vulnerable to political influence and other factors such as lobbying.

The conceptual framework is an articulate system of interconnected objectives and essentials that can lead to constant standards which would describe financial accounting and financial statements.

The Accounting standards, on the other hand, are the ways that you follow while preparing accounts. These standards are usually decided upon by professional bodies that at as oversight in financial accounting. They reduce the variety of options that can be used in making financial reports, increase the level of disclosure, and provide a focal point that levels debates in accounting.

Summary

A summary of the differences highlighted between the conceptual frameworks and accounting standards.

| Topic | Conceptual Framework | Accounting standards |

| Function | They assist auditors and preparers of financial statement to best put in practice the regulations provided by the IFRS.

|

encourage and champion the use of sound financial systems in the local sector while promoting financial solidity globally |

| Flexibility | A conceptual framework is flexible and can be designed in an accounting function | Accounting standards are rigid and cannot be designed to fit different perspectives of financial accounting |

| Benefits | It helps to affirm the credibility that a financial statement is credible | Help investors and stakeholders to access information that they would not have accessed due to non-disclosure policies. |

In conclusion, the comparison of the conceptual framework and accounting standards outline an in-depth definition of the two financial accounting concepts. The differences as outlined in the paper portray the way in which the two subjects of discussed are applied in financial accounting. The key note of the discussion is that, while we cannot directly relate the 2, the understanding of their differences enlightens their importance. Accounting standards that are used in GAAP are continuously shifting the edges of IFRS and GAAP, towards a harmony that will help in synchronizing financial accounting in the IFRS and GAAP systems. Conceptual frameworks, on the other hand, continue to create clear financial accounting charts that immensely contribute to the realization of comprehensive financial statements that are better and easy to read and interpret.

- Difference between Traditional Commerce and Ecommerce - February 16, 2018

- The Differences between Copay and Deductible - February 6, 2018

- Differences between Personal Property and Real Property - January 29, 2018

Search DifferenceBetween.net :

1 Comment

Leave a Response

References :

[0]https://ocw.mit.edu/courses/sloan-school-of-management/15-514-financial-and-managerial-accounting-summer-2003/index.htm

[1]https://en.wikipedia.org/wiki/Accounting_Standards_Board_(Canada)

The article really helps me to understand difference between financial accounting standards and conceptual frame work