Difference Between Venture Capital and Angel Investors

Starting and running a business is no walk in the park. Among the multitude of challenges experienced include lack of experience, inadequate market or product research, low sales, not to mention lack of capital. While not all businesses have capital inadequacies, most have to seek funding in the business cycle to keep the business running. Among methods used gain capital includes looking for investors, who give capital to a business the expectations of earning a return on the investment made. Some of these are venture capitalists and angel investors.

What is Venture Capital?

These are funds from third parties used to finance developing business ventures. The third parties could be banks, pension funds, insurance companies, financial institutions not to mention high net worth persons.

Although most known for the financial assistance in businesses, venture capitalists also assist in business networking, product development, sales expertise and advertising strategies. Forms of venture capital can be income notes, equity financing, conditional loan and participating debenture.

Venture capital provides long term investment of more than 3 years. The set conditions to this are also strict; hence most businesses may not be able to get venture capital. For instance, venture capitalists expect a higher return on the investment.

What is Angel Investors?

Also referred to as informal investors or business angels, these are high net worth individuals who provide personal funds to promising developing businesses to genere profit. The investment is done upon verifying the growth potential and the period it might take them to recoup the investment amount.

Angel investors can fund a business through a lump-sum investment or constant funds to enable run business operations smoothly. Although the most funding involves a business loan, the investors may also fund the business through common stock or a preferred convertible stock. These investors do not invest a lot of money in the business as opposed to venture capitalist. Their expected return is also less.

Angel investors provide favorable terms and conditions, and tend to take more risks, which is ideal for a struggling business. This may, however, cause laxity among business owners. While most angel investors are not involved in the running of the business, others are actively involved in the business operations, acting as business mentors and helping in decision making.

Similarities Venture Capital and Angel Investors

- Both invest in a business with the expectation of earning a return on the investment made

- Both provide capital and non-capital gains to a business

Differences Venture Capital and Angel Investors

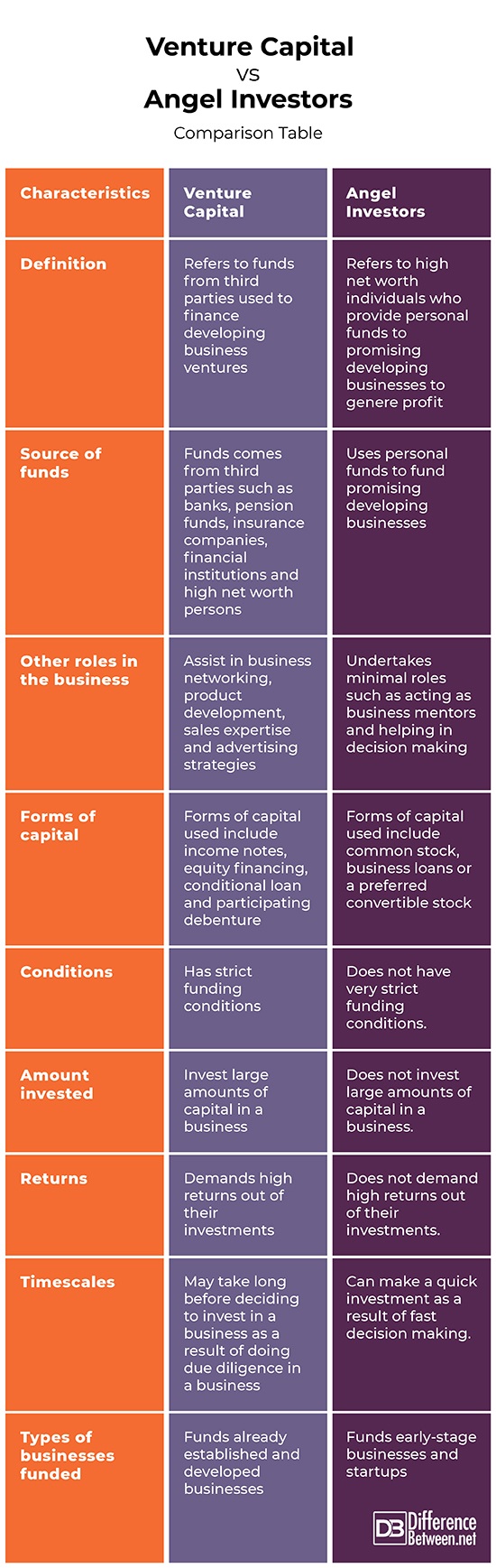

Definition

Venture capital refers to funds from third parties used to finance developing business ventures. On the other hand, angel investors refers to high net worth individuals who provide personal funds to promising developing businesses to generate profit.

Source of funds

While venture capital comes from third parties such as banks, pension funds, insurance companies, financial institutions and high net worth persons, angel investors use personal funds to fund promising developing businesses.

Other roles in the business

Venture capitalists assist in business networking, product development, sales expertise and advertising strategies. On the other hand, angel investors undertake minimal roles such as acting as business mentors and helping in decision making.

Forms of capital

Forms of venture capital used include income notes, equity financing, conditional loan and participating debenture. On the other hand, angel investors use forms of capital including common stock, business loans or a preferred convertible stock.

Conditions

While venture capital has strict funding conditions, angel investors do not have very strict funding conditions.

Amount invested

Venture capitalists invest large amounts of capital in a business. On the other hand, angel investors do not invest large amounts of capital in a business.

Returns

While venture capitalists demand high returns out of their investments, angel investors do not demand high returns out of their investments.

Timescales

While venture capitalists may take long before deciding to invest in a business as a result of doing due diligence in a business, angel investors can make a quick investment as a result of fast decision making.

Types of businesses funded

Venture capital funds already established and developed businesses. On the other hand, angel capital funds early-stage businesses and startups.

Venture capital vs. Angel Investors: Comparison Table

Summary of Venture Capital vs. Angel Investors

Venture capital refers to funds from third parties used to finance developing business ventures. Although venture capitalists may demand high returns out of their investments, they assist in business networking, product development, sales expertise and advertising strategies.

On the other hand, angel investors refers to high net worth individuals who provide personal funds to promising developing businesses to generate profit. They are preferred for startups as they do not have strict funding conditions, do not demand high returns out of their investments and can make a quick investment as a result of fast decision making. Both, however, remain important funding options both for large and small businesses.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Image credit: https://live.staticflickr.com/7290/9616144355_cf37ae2086_b.jpg

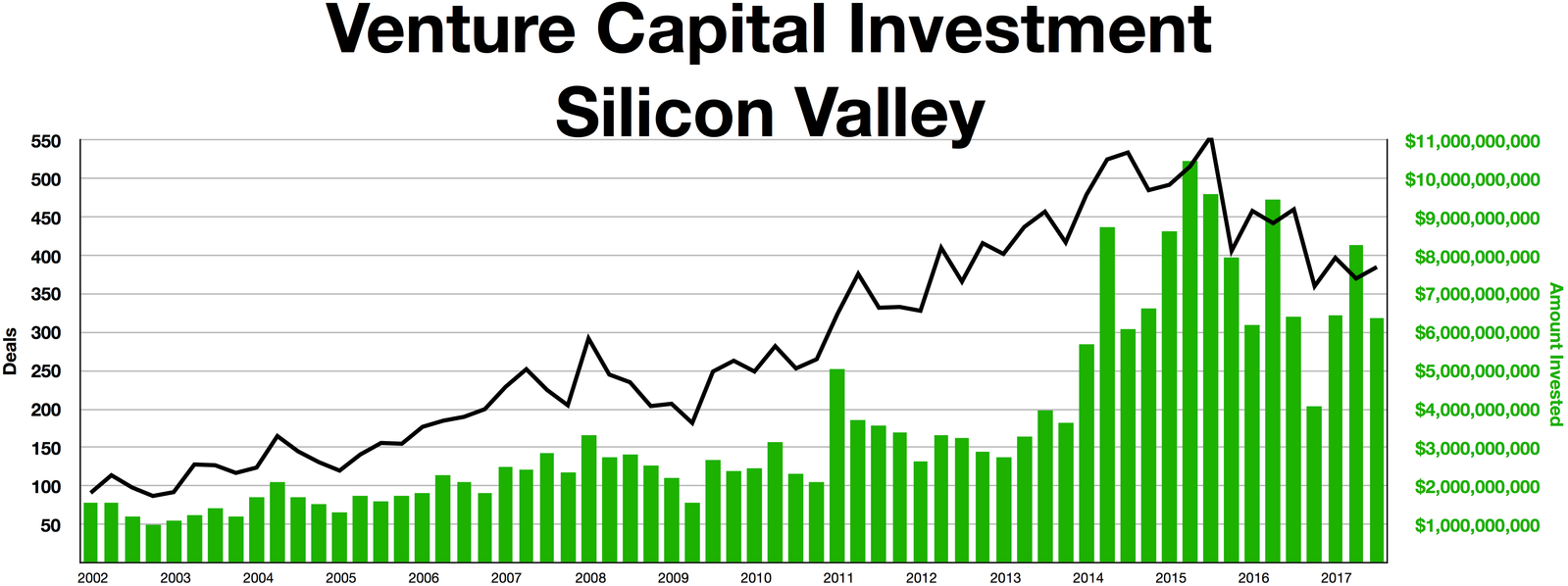

[1]Image credit: https://commons.wikimedia.org/wiki/File:Silicon_Vally_Venture_Capital_investment.png

[2]OECD. Financing High-Growth Firms The Role of Angel Investors: The Role of Angel Investors. OECD Publishing, 2011. https://books.google.co.ke/books?id=g1HLqUMnm0oC&printsec=frontcover&dq=difference+between+venture+capital+and+angel+investors&hl=en&sa=X&ved=0ahUKEwi67Pvd-P3mAhWFYsAKHRemARUQ6AEIJzAA#v=onepage&q=difference%20between%20venture%20capital%20and%20angel%20investors&f=false

[3]Margulis J & Benjamin G. Angel Capital: How to Raise Early-Stage Private Equity Financing. John Wiley & Sons Publishers, 2005. https://books.google.co.ke/books?id=GTSTDiXpA0kC&pg=PA100&dq=difference+between+venture+capital+and+angel+investors&hl=en&sa=X&ved=0ahUKEwi67Pvd-P3mAhWFYsAKHRemARUQ6AEINjAC#v=onepage&q=difference%20between%20venture%20capital%20and%20angel%20investors&f=false

[4]Jens Ortgiese. Value Added by Venture Capital Firms: An Analysis on the Basis of New Technology-based Firms in the USA and Germany. Josef Eul Verlag GmbH Publishers, 2007. https://books.google.co.ke/books?id=DOnuewO7aqsC&pg=PA15&dq=difference+between+venture+capital+and+angel+investors&hl=en&sa=X&ved=0ahUKEwi67Pvd-P3mAhWFYsAKHRemARUQ6AEIVzAG#v=onepage&q=difference%20between%20venture%20capital%20and%20angel%20investors&f=false