Difference Between Bank Run and Bank Panic

Remember the Great Depression in the 1930s that left most of the world in an economic downturn? Yes, the same financial crisis that shook the whole world and engulfed almost every manufacturing country and food producer. From 1929 to 1933, the money supply fell by a dramatic 28 percent followed by a wave of bank runs and closures of banks and financial institutions. It all started with the stock market crash but accompanied by tons of bank runs. This begs the million dollar question – what is a bank run? This leads to the next question – what are bank panics and how the two are related? Let’s take a look.

What is Bank Run?

On a normal day, a bank keeps sufficient reserves to fulfill the withdrawal needs of its depositors. Typically, this amount is much less than the total deposit amounts because the bank uses a fraction of demandable deposits to finance long-term loans and holds only enough reserves for its depositors. However, the banking system is fragile, especially the commercial banks under the fractional-reserve banking system. So, when all depositors request a large volume of withdrawals all at once, the bank fails to meet the withdrawal needs of all its depositors, in which case a financial crisis called ‘bank panic’ occurs. Fearing bank collapse or losing confidence in the banks, the depositors make a run for the banks for immediate cash withdrawals almost at the same time, which forced the banks to close their doors till further notice. Bank run is a financial crisis that occurs when depositors lose confidence in the banking system or suspect that a bank may cease to function.

What is Bank Panic?

Bank panic is a financial crisis that occurs when multiple banks suffer runs at the same time, as depositors make a run for the banks simultaneously fearing the banks will become insolvent. Unable to meet the withdrawal needs of its depositors, the banks are forced into costly and time-consuming liquidation of assets. Bank panics are randomly occurring events that create a sense of fear among the depositors and expose them to the risk of loss. The fear of random deposit withdrawals and the risk of not being able to withdraw funds from the banks trigger a random but serious event called a bank run, which eventually turns to bank panics. A rapidly changing environment is a prerequisite to financial instability, though not all banking panics are associated with recessions. However, during recessions, many businesses go bankrupt, so fewer bank loans are repaid. The bank with unusual number of bad loans would be in big trouble, and if the depositors got a hint of this, there might be a run on the bank. So, a bank run might lead to bank panics, which might cause a serious financial problem for the nation.

Difference between Bank Run and Bank Panic

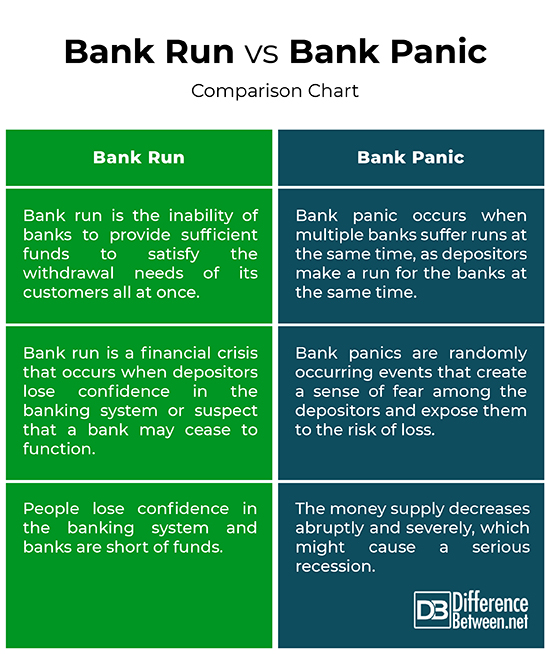

Meaning

– When a significant number of customers or clients of a bank or financial institution make a run for the banks to withdraw their respective deposit amounts all at the same time over concerns of bank’s efficiency and ability to function in the near future, an unexpected event takes place which is nothing less of a financial crisis. This period is called a bank run. When multiple banks suffer similar fate and face runs at the same time over concerns of banks becoming insolvent, this random chain of events cause banking panics or bank panics.

Cause

– Bank run is a financial crisis that occurs when depositors lose confidence in the banking system or suspect that a bank may cease to function. Fearing bank collapse or losing confidence in the banks, the depositors make a run for the banks for immediate cash withdrawals almost at the same time. Hearing that their neighboring banks were facing a cash crunch might lead the customers of other banks to question the efficiency of their own banks. They might as well want to withdraw their own funds, resulting in a similar situation which would eventually force them to close their doors too. This creates bank panics.

Effect

– Bank runs and bank panics can have serious consequences for everyone, from customers to banks and ultimately the nation. First, people lose confidence in the banking system and banks are short of funds. Second, the simultaneous withdrawal of funds from multiple banks leads to the depletion of the banking system’s reserves. This whole situation complicates the control of the money supply and this sudden decrease in the money supply can cause a recession, which is really bad. When banking panics occur, the money supply decreases abruptly and severely, which might cause a serious recession, like the Great Depression that lasted from 1929 to 1939.

Bank Run vs. Bank Panic: Comparison Chart

Summary of Bank Run vs. Bank Panic

Bank runs not only destabilize the banking system abruptly and quickly, but complicate the control of the money supply, which might cause a serious recession. Because banks and other financial institutions keep only a small fraction of their deposits in reserve, they cannot fulfill the withdrawal needs of all of their customers in a single go. Even if a bank is solvent, meaning its assets are worth more than its liabilities, it may run out of cash because of the sudden surge in demand to withdraw money and face sudden bankruptcy. The banks are forced to close their doors until some of the bank loans are repaid or some lender like the Fed lends some immediate cash to pay off the depositors as a last resort.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

References :

[0]Mankiw, N. Gregory. Principles of Economics (Volume 1). Massachusetts, United States: Cengage, 2008. Print

[1]Rochet, Jean-Charles. Why Are There So Many Banking Crises?: The Politics and Policy of Bank Regulation. Princeton, New Jersey: Princeton University Press, 2008. Print

[2]Allen, Franklin and Douglas Gale. Understanding Financial Crises. Oxford, England: Oxford University Press, 2009. Print

[3]Ziegler, Alexandre C.. A Game Theory Analysis of Options: Corporate Finance and Financial Intermediation in Continuous Time. Berlin, Germany: Springer, 2004. Print

[4]Betz, Frederick. Why Bank Panics Matter: Cross-Disciplinary Economic Theory. Berlin, Germany: Springer, 2013. Print

[5]Hall, Robert and Marc Lieberman. Economics: Principles and Applications. Massachusetts, United States: Cengage, 2007. Print