Difference Between Debit and Credit Spread

If you’re considering an investment strategy with high potential for returns and fewer risks involved, options trading is a great place to start. While options trading may be a bit complicated for beginners, there are lots of tools and strategies available out there from which the novice trader starts to get benefits, generating healthy returns month after month. Spreads are the basic building blocks of several options trading strategies and some of the simplest option strategies a trader can implement. Spreads can be classified in many ways, one being whether or not the strategy is a debit spread or credit spread.

What is Debit Spread?

Debit spread is a directional option buying strategy mostly used by beginners. A debit spread is when you buy an option with a higher premium and sell an option with a lower premium on the same underlying security, same expiration date but different strike prices. A debit spread is a strategy for you if you’re moderately bullish of the market and you expect a slight rise in the price of underlying in the near future. It means you pay for them and hope your directional pick is correct. If the strike price of the sold option is further from the market price than the strike price of the purchased option, then this is going to be a debit spread. You stand to profit when the stock price increases and it’s one of the four vertical spread options strategies.

What is Credit Spread?

Credit Spread is simple options strategy that is popular among income-driven traders, and you profit from stock price increases, decreases, or even if the stock price doesn’t move at all. Credit spreads have a high probability of making money, compared to debit spreads. The strategy involves purchasing of one option and simultaneous sale of another option in the same asset class but with different strike prices. It means you sell one option and buy another option at a further strike price in the same expiration cycle. The option you sell is more expensive than the option you buy which will lead to a net credit when entering the position. This is why it’s called a credit spread because you (the investor) collect money for it.

Difference between Debit and Credit Spread

Convention

– If the strike price of the sold option is further from the market price than the strike price of the purchased option, then this is going to be a debit spread. Credit spreads involve purchasing of one option and simultaneous sale of another option in the same asset class but with different strike prices. It means you sell one option and buy another option at a further strike price in the same expiration cycle.

Cash Flow

– In case of debit spreads, a lower strike call is being purchased and a higher strike call is being sold, so the result is a negative cash flow, or a debit. It’s called a debit spread because the investor must pay for it. In case of credit spreads, purchasing the lower strike put and selling the higher strike put results in a positive initial cash flow, or a credit. It is called a credit spread because the investor collects premium for it.

Optimal Scenario

– A debit spread is when you are moderately bullish of the market, and you expect a slight rise in the price of underlying in the near future. It means you pay for them and hope your directional pick is correct. If you expect a small directional move that’s when you want to sell a credit spread. Higher implied volatility conditions are better for selling credit spreads and lower implied volatility conditions are better for buying debit spreads.

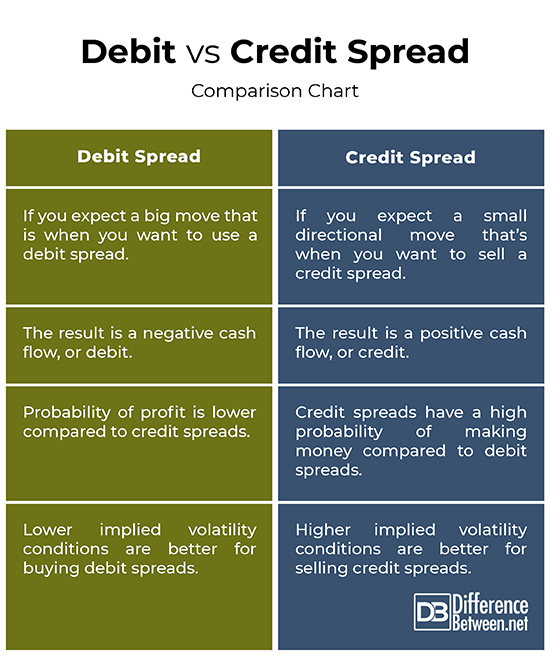

Debit vs. Credit Spread: Comparison Chart

Summary

Higher implied volatility conditions are better for selling credit spreads and lower implied volatility conditions are better for buying debit spreads. If earnings are coming up and the stock is going to make a big move and you have a directional view, that is when you want to use a debit spread. On the other hand, if you expect a small directional move that’s when you want to sell a credit spread. Options spreads are some of the most powerful tools available when trading options. You can find options spread amongst complex trades.

Which is better debit or credit spreads?

Credit spreads have a high probability of making money, compared to debit spreads. Also, they have less directional risk as opposed to debit spreads. Credit spreads will pay more money, have fewer risks, and high expected returns.

When should I use a credit spread vs. a debit spread?

If you expect that the stock is going to make a big move and you have a directional view that is when you want to use a debit spread. If you expect a small directional move that’s when you want to sell a credit spread.

Why debit spreads are better?

You stand to profit when the stock price increases and it’s one of the four vertical spread options strategies. Debit spreads tend to be more directional, whereas in credit spreads the investor collects money from it.

Is put credit spread same as call debit spread?

Put credit spreads are a profitable trade wherein the seller collects a credit when the trade is entered whereas call debit spreads require the buyer to pay a debit at trade entry. So, the two are not the same.

- Difference Between Caucus and Primary - June 18, 2024

- Difference Between PPO and POS - May 30, 2024

- Difference Between RFID and NFC - May 28, 2024

Search DifferenceBetween.net :

Leave a Response

References :

[0]Saliba, Anthony J. Option Spread Strategies: Trading Up, Down, and Sideways Markets. New Jersey, United States: John Wiley & Sons, 2010. Print

[1]Hanson, Scott and Charles Conrick, IV. Vertical Option Spreads: A Study of the 1.8 Standard Deviation Inflection Point. New Jersey, United States: John Wiley & Sons, 2017. Print

[2]Nations, Scott. The Complete Book of Option Spreads and Combinations: Strategies for Income Generation, Directional Moves, and Risk Reduction. New Jersey, United States: John Wiley & Sons, 2014. Print

[3]Jensen, Greg. Spread Trading: An Introduction to Trading Options in Nine Simple Steps. New Jersey, United States: John Wiley & Sons, 2009. Print