Difference Between GAAP and Budgetary basis

The need for financial reporting cannot be underestimated. Without the proper financial recording, it would be impossible to make long-term decisions in enterprises, improve performance, maintain records, help potential investors know the financial position of a business not forgetting maintaining records. The accounting processes are guided by set principles that guide how entities must report financial data. These helps to govern the accounting world in accordance with general guidelines and rules. The generally accepted accounting principles (GAAP) govern how accounting data are reported globally. However, there exist different accounting provisions. In this article, we will look at the difference between GAAP and the Budgetary basis.

What is GAAP?

Generally accepted accounting principles (GAAP) are common accounting procedures, standards and principles set by the FASB. It is a combination of the commonly accepted accounting recording procedures and authoritative standards as set by policy boards.

In the United States, public companies must adhere to the GAAP regulations in financial reporting. Globally, GAAP principles help in the governance of accounting while also standardizing and regulating the methods, assumptions and definitions. However, GAAP standards vary from one industry or geographic location to another.

Among the GAAP principles include:

- Regularity- All accounts must follow set regulations and rules

- Consistency- The accounting financial reporting follow set standards consistently

- Sincerity- Accountants are committed to impartiality and accuracy

- Permanence methods- The preparation of financial reports follows consistent procedures

- Non-Compensation- Reporting of all organization’s performance are carried with no prospect of compensation

- Prudence- Financial reporting is not carried out under speculation

- Continuity- The continuity of an organization’s operations is assumed in asset valuations

- Periodicity- Accounting periods dictate the reporting periods

- Materiality- An organization’s financial situation is disclosed via financial reporting

- Utmost Good Faith- Honesty is assumed among all involved parties

The primary method of calculating and recording information used in GAAP is the accrual basis whereby transactions are recorded the same time they take place.

What is Budgetary Basis?

This is an accounting reporting method that uses the cash plus constraint or a modified accrual basis method to maintain accounting records and prepare budgets. In the cash basis, revenues are accounted for at the time when received while expenditures are accounted for when paid.

In instances where a non-GAAP basis is used in the maintenance of accounting records, adjustments will be required for reporting purposes at the end of the year. Also, various revenues and expenditures are treated differently. For reporting purposes, they are also reconciled accordingly. In the budgetary basis, expenditures are recorded when remitted in cash while encumbrances are treated as expenditures. Appropriations are reported among other uses and sources of funds in the general fund. This helps prove compliance for the reporting period’s authorized period.

Similarities between GAAP and Budgetary basis

- Both govern recording procedures in accounting

Differences between GAAP and Budgetary basis

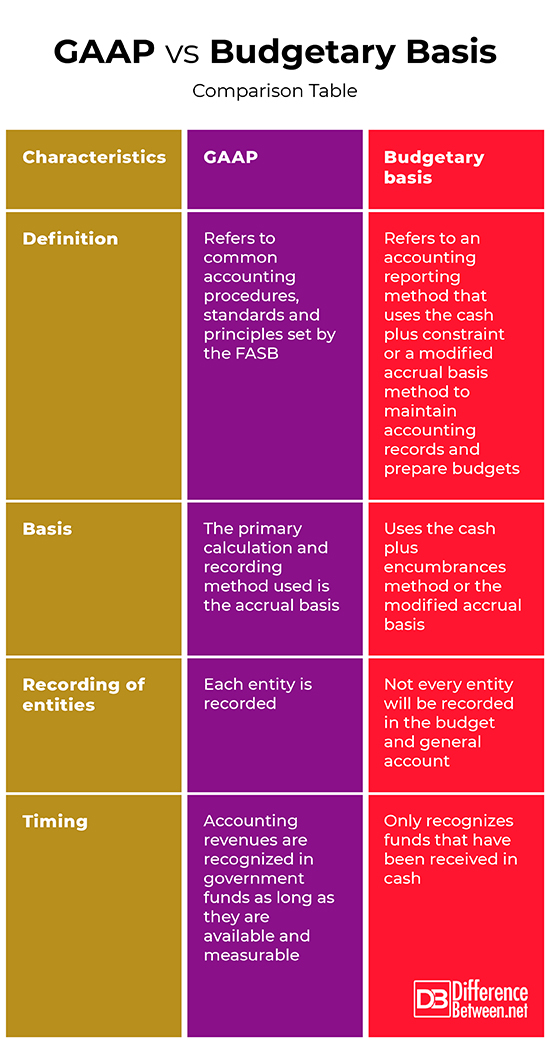

Definition

GAAP refers to common accounting procedures, standards and principles set by the FASB. On the other hand, budgetary basis refers to an accounting reporting method that uses the cash plus constraint or a modified accrual basis method to maintain accounting records and prepare budgets.

Basis

While the primary calculation and recording method used in GAAP is the accrual basis, the budgetary basis uses the cash plus encumbrances method or the modified accrual basis.

Recording of entities

In GAAP, each entity is recorded. On the other hand, not every entity will be recorded in the budget and general account.

Timing

Accounting revenues in GAAP are recognized in government funds as long as they are available and measurable. On the other hand, the budgetary basis only recognizes funds that have been received in cash.

GAAP vs. Budgetary Basis: Comparison Table

Summary of GAAP vs. Budgetary basis

GAAP refers to common accounting procedures, standards and principles set by the Financial Accounting Standards Board (FASB). On the other hand, budgetary basis refers to an accounting reporting method that uses the cash plus constraint or a modified accrual basis method to maintain accounting records and prepare budgets. A budget document should clearly define the accounting basis used for budgetary purposes. If the GAAP and the budgetary basis are different, the similarities and differences should be noted. Disparities such as timing, basis, entity and fund structure must be noted.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Warren Ruppel. Wiley GAAP for Governments 2009: Interpretation and Application of Generally Accepted Accounting Principles for State and Local Governments. John Wiley & Sons, 2009. https://books.google.co.ke/books?id=yHs4uK_iLWcC&pg=PA131&dq=Difference+between+GAAP+and+Budgetary+basis&hl=en&sa=X&ved=2ahUKEwjiiIr2g_TuAhVE5uAKHYjoDc4Q6AEwAHoECAQQAg#v=onepage&q=Difference%20between%20GAAP%20and%20Budgetary%20basis&f=false

[1]Joanne M. Flood. Wiley GAAP 2019: Interpretation and Application of Generally Accepted Accounting Principles. John Wiley & Sons, 2019. https://books.google.co.ke/books?id=9NCFDwAAQBAJ&printsec=frontcover&dq=GAAP&hl=en&sa=X&ved=2ahUKEwia04u0hPTuAhXMAGMBHQLWD7QQ6AEwAHoECAQQAg#v=onepage&q=GAAP&f=false

[2]Saafir N & Epstein B. Wiley GAAP: Practical Implementation Guide and Workbook. John Wiley & Sons, 2010. https://books.google.co.ke/books?id=OLDUQF_wc7YC&printsec=frontcover&dq=GAAP&hl=en&sa=X&ved=2ahUKEwia04u0hPTuAhXMAGMBHQLWD7QQ6AEwAXoECAMQAg#v=onepage&q=GAAP&f=false

[3]Image credit: https://commons.wikimedia.org/wiki/File:Benefits_of_Lean_Accounting_3-2_(1).png

[4]Image credit: https://upload.wikimedia.org/wikipedia/commons/4/45/Budgetary_Impact_of_Health_Reform_Bills.JPG