Difference Between EBIT and Cash Flow

The determination of liquidity or profitability in a profit-making venture is paramount. While this is often ignored especially when a firm’s performance is reputable, ignoring these two may translate to expensive mistakes in the future. Analysts use various metrics to measure this such as cash flow, EBIT (Earnings before interest and taxes) or EBITDA (Earnings before interest, taxes, depreciation and amortization). But what is the difference between these metrics?

What is EBIT?

Short of Earnings before Interest and Taxes, EBIT is a metric used to determine a company’s profitability by taking into account the revenue without tax expenses and capital structure. By ignoring interest and taxes, EBIT can measure a firm’s ability to generate profit from its operations without the capital structure or tax burden.

To calculate EBIT, the operating expenses and cost of goods sold are deducted from revenue. It can also be calculated by adding the interest, net income and taxes. In this case, operating expenses also include employee wages.

Why is the calculation of EBIT important? When analyzed, EBIT shows whether a company can generate profit, fund its operations and pay any debts. It is also important in analyzing tax situations to investors. It is vital when analyzing companies whose operations are capital intensive. The core importance of EBIT is the determination of whether a company is profitable from its core operations without factoring indirect expenses.

What are the limitations of EBIT?

- It may produce unfair results for companies that have fixed assets since they would have a higher depreciation expense

- It is unfavourable for firms with large debt amounts since they have a high-interest expense. It is vital to consider debt when analysing financial statements in any enterprise

What is Cash Flow?

Cash flow is the total cash and cash equivalents that are transferred in and out of a company within a given time whereby the amount of received cash is inflow while the cash spent is outflow. The capability of a company to create value for investors and other shareholders is often determined by the ability to generate positive cash flows and maximize its long-term free cash flow.

Cash flow is one of the most important operating tools in any business. When money is taken in as sales, it translates to revenue. Other sources of revenue include investments, interest and royalties. This is then used on expenses. Analysts need to assess the timing, amounts and uncertainty that comes with cash flow in financial reporting. A good cash flow translates to flexibility, liquidity and good financial performance. A positive cash flow enables businesses to pay off its debts, expand, timely cater for the expenses and save for future financial challenges.

There are different types of cash flows including cash flow from financing, cash flow from investing and cash flow from operations. These are analyzed from the company’s cash flow statement which records the firm’s cash transactions and also shows whether revenues that have been booked on the income statement have been collected.

What are the limitations of cash flow?

- It does not show all the firm’s expenses. This is because some expenses that a company accrues may not be paid immediately.

Similarities between EBIT and Cash Flow

- Both are used to measure the liquidity and profitability of businesses

Differences between EBIT and Cash Flow

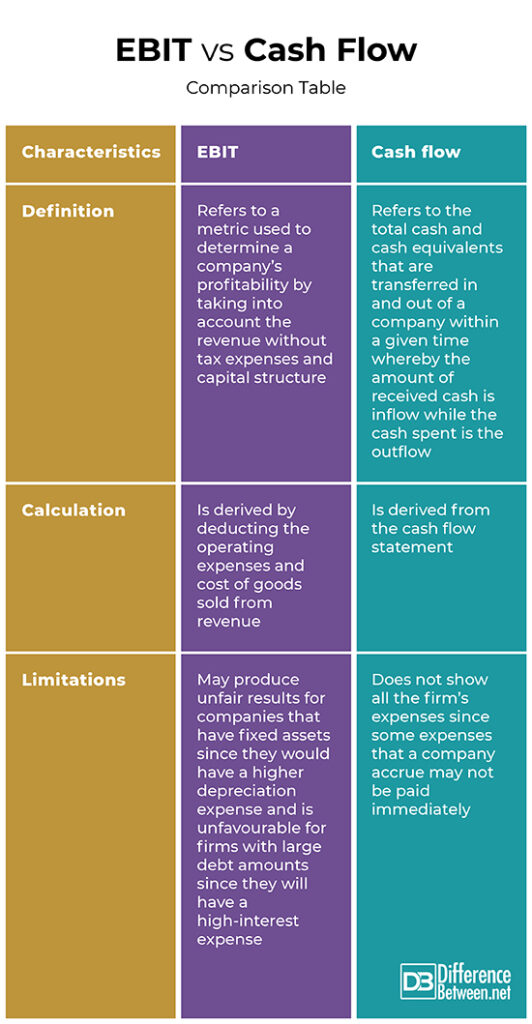

Definition

EBIT refers to a metric used to determine a company’s profitability by taking into account the revenue without tax expenses and capital structure. On the other hand, cash flow refers to the total cash and cash equivalents that are transferred in and out of a company within a given time whereby the amount of received cash is inflow while the cash spent is outflow.

Calculation

EBIT is derived by deducting the operating expenses and cost of goods sold from revenue. On the other hand, cash flow is derived from the cash flow statement.

Limitations

EBIT may produce unfair results for companies that have fixed assets since they would have a higher depreciation expense and is unfavourable for firms with large debt amounts since they will have a high-interest expense. On the other hand, cash flow does not show all the firm’s expenses since some expenses that a company accrue may not be paid immediately.

EBIT vs. Cash Flow: Comparison Table

Summary of EBIT vs. Cash Flow

EBIT refers to a metric used to determine a company’s profitability by taking into account the revenue without tax expenses and capital structure. On the other hand, cash flow refers to the total cash and cash equivalents that are transferred in and out of a company within a given time whereby the amount of received cash is inflow while the cash spent is outflow. While the two differ, they are used to measure profitability and liquidity in companies.

FAQs

Is EBIT the same as cash flow?

No. EBIT is not the same as cash flow.

What’s the difference between cash flow and EBITDA?

Cash flow is the use of cash and cash equivalents to measure liquidity and profitability. EBITDA measures these via earnings made before interest, tax, depreciation and amortization.

Is EBIT free cash flow?

No.

How do you calculate cash flow from EBIT?

FCFF = (EBIT *(1-tax rate)) + Depreciation – Fixed capital Investment – Working capital investment

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Dr. N. Sivasankaran. Taxmann's Financial Analysis for Beginners – Comprehensive Ready Reckoner to Understand the Intricacies of Finance & Accounting using Financial Analysis Tools with Simple Illustrations. Taxmann Publications Private Limited, 2021. https://books.google.co.ke/books?id=BK1JEAAAQBAJ&printsec=frontcover&dq=Difference+between+ebit+and+cash+flow&hl=en&sa=X&redir_esc=y#v=onepage&q=Difference%20between%20ebit%20and%20cash%20flow&f=false

[1]Pareja I & Tham J. Principles of Cash Flow Valuation: An Integrated Market-Based Approach. Academic Press, 2004. https://books.google.co.ke/books?id=-0BqFFQmKloC&printsec=frontcover&dq=Difference+between+ebit+and+cash+flow&hl=en&sa=X&redir_esc=y#v=onepage&q=Difference%20between%20ebit%20and%20cash%20flow&f=false

[2]Franzen D & Wilde S. Corporate Valuation - Lanxess AG. GRIN Verlag, 2013. https://books.google.co.ke/books?id=BubIaoZ6RagC&printsec=frontcover&dq=Difference+between+ebit+and+cash+flow&hl=en&sa=X&redir_esc=y#v=onepage&q=Difference%20between%20ebit%20and%20cash%20flow&f=false