Difference Between Fintech and Banks

The banking industry has greatly evolved from the use of loans of grains as collateral in ancient Babylonia and Assyria. If we were to go back to the period before technology innovations, the banking systems would catch us off guard. More technology innovations are occurring every day, resulting to new banking methods, other than traditional banks. Most traditional banking systems are also backed by Fintech and Fintech products. Although fintech is commonly viewed as a disruption to the banking industry, the benefits cannot be matched. In this article, we discuss the differences between fintech and banks.

What is Fintech?

Fintech, short of financial technology, is a term used to describe new technology that automates and improves the delivery of financial services. It uses algorithms and specialized software on computers and smartphones and is used to manage financial processes, operations and lives by consumers, business owners and companies. An additional component of fintech is the development of cryptocurrencies

Fintech has now shifted to more consumer-based services and is now used in various sectors including retail banking, education, investment management and non-profit, just to name a few. Among functions which incorporate fintech include depositing cheques with smartphones, money transfers, managing investments, applying for credit and any assistance that do not require a person but uses technology.

Others include;

- Crowdfunding platforms such as GoFundMe and Kickstarter- These allow app and internet users send and receive money.

- Budgeting apps

- Digital cash and cryptocurrencies

- Smart contacts which automatically executes contracts between sellers and buyers

- Open banking

- Insurtech- This aims to streamline and simplify the insurance industry

The trend towards increased information, mobile banking, decentralized access and accurate analytics has created opportunities for consumers, B2B and B2C to lean towards fintech services.

What are Banks?

These are financial institutions that is licensed to accept deposits from its customers and make loans. Although there are different kinds of banks including investment banks, retail banks and corporate banks, they are regulated by the central bank or the national government.

The importance of banks in the economies cannot be ignored. Through different account types, customers can carry out transactions including routine banking transactions such as withdrawals, deposits and bill payments not to mention the ability of customers to earn interest on their investments as well as save and borrow money. Banks also provide currency exchange, wealth management and safe deposit boxes.

Similarities between Fintech and Banks

- Both aim at providing consumers with seamless financial services

Differences between Fintech and Banks

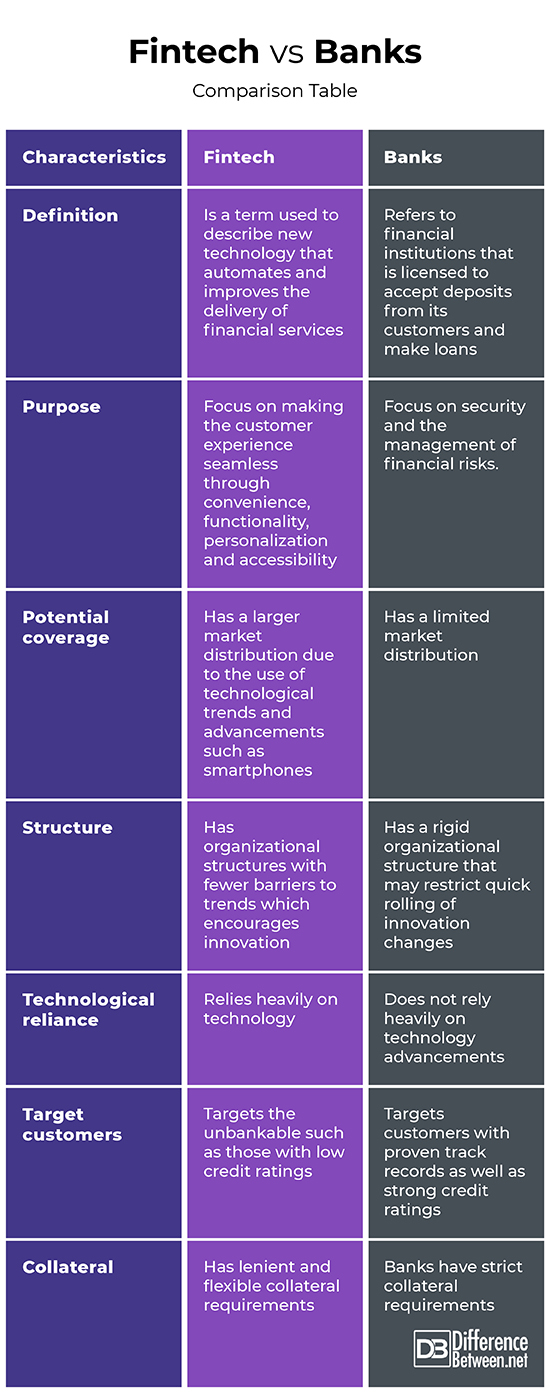

Definition

Fintech is a term used to describe new technology that automates and improves the delivery of financial services. On the other hand, banks refer to financial institutions that is licensed to accept deposits from its customers and make loans.

Purpose

While fintech companies focus on making the customer experience seamless through convenience, functionality, personalization and accessibility, banks focus on security and the management of financial risks.

Potential coverage

Due to the use of technological trends and advancements such as smartphones, fintech has a larger market distribution. On the other hand, banks have a limited market distribution.

Structure

Fintech has organizational structures with fewer barriers to trends which encourages innovation. On the other hand, banks have a rigid organizational structure that may restrict quick rolling of innovation changes.

Technological reliance

While fintech companies rely heavily on technology, banks do not rely heavily on technology advancements.

Target customers

While fintech targets the unbankable such as those with low credit ratings, banks target customers with proven track records as well as strong credit ratings.

Collateral

FinTech has lenient and flexible collateral requirements. On the other hand, banks have strict collateral requirements.

Fintech vs. Banks: Comparison Table

Summary of Fintech and Banks

Fintech is a term used to describe new technology that automates and improves the delivery of financial services. It focuses on making the customer experience seamless through convenience, functionality, personalization and accessibility. As a result, it has a larger market distribution due to the use of technological trends and advancements. On the other hand, banks refer to financial institutions that is licensed to accept deposits from its customers and make loans. They focus on security and the management of financial risks and as a result have a limited market distribution.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Chris Skinner. Digital Bank: Strategies to launch or become a digital bank. Marshall Cavendish International Asia Pte Ltd, 2014. https://books.google.co.ke/books?id=ch1xAwAAQBAJ&printsec=frontcover&dq=Difference+between+Fintech+and+Banks&hl=en&sa=X&ved=2ahUKEwiJtPrzjIzqAhVnlosKHWZQAvYQ6AEwAXoECAAQAg#v=onepage&q=Difference%20between%20Fintech%20and%20Banks&f=false

[1]Schena C & Tanda A. FinTech, BigTech and Banks: Digitalisation and Its Impact on Banking Business Models. Springer Publishers, 2019. https://books.google.co.ke/books?id=Ll6mDwAAQBAJ&pg=PA3&dq=Difference+between+Fintech+and+Banks&hl=en&sa=X&ved=2ahUKEwiJtPrzjIzqAhVnlosKHWZQAvYQ6AEwA3oECAYQAg#v=onepage&q=Difference%20between%20Fintech%20and%20Banks&f=false

[2]Hacioglu & Umit. Handbook of Research on Strategic Fit and Design in Business Ecosystems. IGI Global Publishers, 2019. https://books.google.co.ke/books?id=7q2rDwAAQBAJ&pg=PA342&dq=Difference+between+Fintech+and+Banks&hl=en&sa=X&ved=2ahUKEwiX0aa7-I_qAhVz7OAKHSQ9Bo4Q6AEwBHoECAEQAg#v=onepage&q=Difference%20between%20Fintech%20and%20Banks&f=false

[3]Image credit: https://live.staticflickr.com/65535/49393885627_8b461bdfe0_b.jpg

[4]Image credit: https://www.picpedia.org/keyboard/images/banks.jpg