Difference Between Coinsurance and Deductible

The importance of healthcare insurance cannot be stressed enough. The need to have a functional health care system globally has been tested by the coronavirus pandemic as well as other epidemics. And with health insurance mandatory in every country, it is important to understand the terms used in healthcare insurance. For instance, coinsurance, copay and deductible are some of the common terms used in health insurance. In this article, we will look at the difference between coinsurance and deductible.

What is Coinsurance?

This is a cost-sharing insurance scheme where the insured pays a fixed percentage of cost and the insurer pays for part of the cost too. The insured pays for a variable percentage of the bill as opposed to a specific amount.

Most insurance companies have an 80/20 coinsurance split policy. As such, the insured pays 20% of the medical costs while the insurer remits 80%. This, however, only applies when the insured has reached the deductible amount. Most insurance providers also have an out-of-pocket maximum value that limits the amount the insured can pay over a certain timeframe. In most instances, the insured must remit the deductible amount before the insurance provider remits the remaining amount.

While the coinsurance policy is common in healthcare insurance, it is also used in property insurance. In this instance, the property insurance takes care of 80% of insurance coverage and the homeowner 20%.

Coinsurance benefits insurers by:

- Reduction of the capital they need to hold to pay for claims

- Improves overall capital management through the reduction of statutory reserves

- It eases financial strains on the insurer

However, coinsurance has various disadvantages

- Since the cost varies, the insured does not have a fixed amount of how much they should remit

What is Deductible?

These are out of pocket costs that the insured must remit either monthly or annually before the insurance coverage kicks in. Deductibles are common in healthcare, property and casualty insurance. The higher the deductible, the lower the monthly or annual premium payments. This is because the insured ends up pays more.

In healthcare, if the insured undertakes a health cover for the entire family, the deductible is set for every individual. Also, if you are healthy, your deductible will be lower as compared to persons with medical conditions that need constant attention.

Advantages

- They help insurance providers share the insurance cost with the policyholders

- They help insurance providers reduce the risk of moral hazards

- It aligns the interest of both the insured and the insurer

- It protects the insurer against financial loss

Similarities between Coinsurance and Deductible

- The insured pays a part of the insurance amount

- Both decrease the amount remitted by the insurance provider

Differences between Coinsurance and Deductible

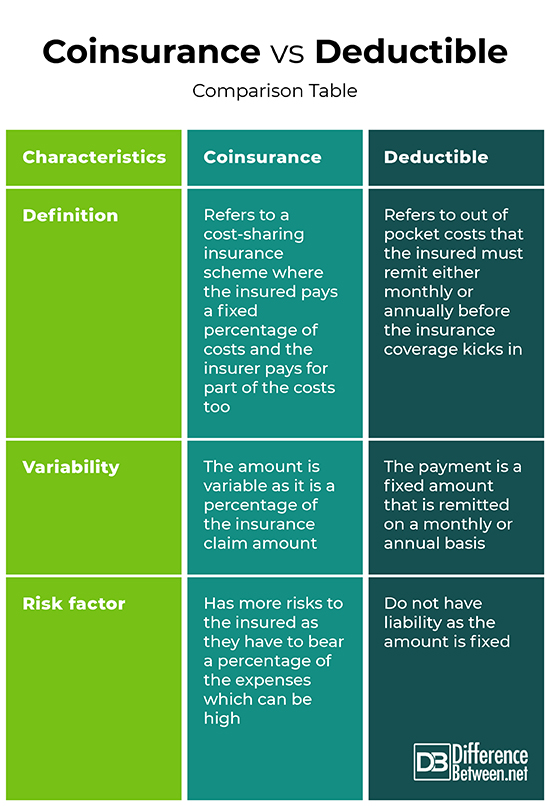

Definition

Coinsurance refers to a cost-sharing insurance scheme where the insured pays a fixed percentage of costs and the insurer pays for part of the costs too. On the other hand, a deductible refers to out of pocket costs that the insured must remit either monthly or annually before the insurance coverage kicks in.

Variability

The coinsurance amount is variable as it is a percentage of the insurance claim amount. On the other hand, the deductible amount is a fixed pyment that is remitted on a monthly or annual basis.

Risk factor

Coinsurance has more risks to the insured as they have to bear a percentage of the expenses which can be high. On the other hand, deductibles do not have liability as the amount is fixed.

Coinsurance vs. Deductible: Comparison Table

Summary of Coinsurance vs. Deductible

Coinsurance refers to a cost-sharing insurance scheme where the insured pays a fixed percentage of cost and the insurer pays for part of the cost too. On the other hand, a deductible refers to out of pocket costs that the insured must remit either monthly or annually before the insurance coverage kicks in. While coinsurance is a variable cost, the deductible is a fixed cost. In both, however, the insured pays a part of the insured amount.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]The University of California. Health Care Financing Review. Department of Health, Education, and Welfare, Health Care Financing Administration, Office of Research, Demonstrations, and Statistics, 2017. https://books.google.co.ke/books?id=Ksfr39_uvOAC&pg=PA23&dq=Difference+between+coinsurance+and+deductible&hl=en&sa=X&ved=2ahUKEwj19MLwj-vuAhXlSxUIHef5AuAQ6AEwAHoECAYQAg#v=onepage&q=Difference%20between%20coinsurance%20and%20deductible&f=false

[1]The University of Michigan. Reorganization of Health Programs in HEW: Hearings, Ninety-third Congress, First Session. U.S. Government Printing Office, 2009. https://books.google.co.ke/books?id=e7rQAAAAMAAJ&pg=PA99&dq=Difference+between+coinsurance+and+deductible&hl=en&sa=X&ved=2ahUKEwj19MLwj-vuAhXlSxUIHef5AuAQ6AEwAXoECAIQAg#v=onepage&q=Difference%20between%20coinsurance%20and%20deductible&f=false

[2]University of Illinois at Urbana-Champaign. Federal Register, Volume 63, Issues 233-235. Office of the Federal Register, National Archives and Records Service, General Services Administration, 2017. https://books.google.co.ke/books?id=IYKJliu9PIkC&pg=PA67083&dq=Difference+between+coinsurance+and+deductible&hl=en&sa=X&ved=2ahUKEwj19MLwj-vuAhXlSxUIHef5AuAQ6AEwA3oECAMQAg#v=onepage&q=Difference%20between%20coinsurance%20and%20deductible&f=false

[3]Image credit: https://live.staticflickr.com/1811/43189662675_20fe85205f_b.jpg

[4]Image credit: https://live.staticflickr.com/7309/11329967245_5178ee7cd5_b.jpg