Difference Between Gross Profit and Net Profit

Business activities are carried out with the aim of earning income to the investors. People who risk their resources and spend considerable time selling goods and services are rewarded by the profits that the business earns after getting back its investment and paying out all the expenses associated with running the business.

Some of the profits earned by an entity include operating profits, gross profits, and net profits. However, it is difficult to differentiate between these types of profits, especially for those people who have no accounting background. This article will elaborate the differences between gross profit and net profit.

What is Gross Profit?

Gross profit refers to the amount of money that is left after deducting all the manufacturing costs from the revenues. One of the importance of gross profit is to demonstrate how the organization is efficient in its production and pricing activities.

Gross Profit= Revenues- Manufacturing Costs

What is Net Profit?

Net profit is the number of earnings that an organization is left with after deducting all the expenses involved in operations, interest, and taxes. Net profit is highly used to demonstrate the ability of the company to convert sales into profits.

Net Profit= Total Income- (Total Expenses-Taxes-Interests)

Difference Between Gross Profit and Net Profit

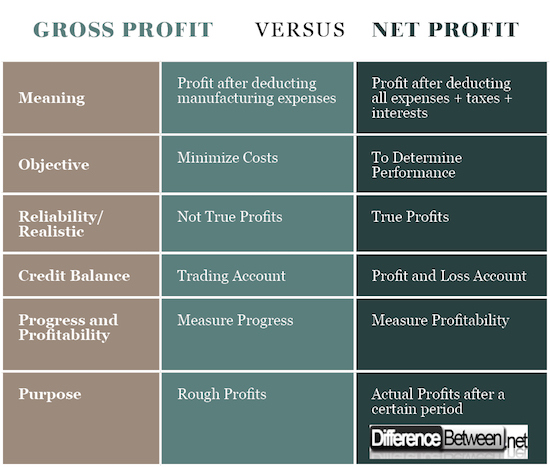

1) Meaning of Gross Profit and Net Profit

One of the main difference between gross profit and net profit is that the two accounting terms are defined differently.

Gross profit describes the profit that an organization is left with after deducting all the direct expenses that are associated with the manufacturing process. It is important to highlight that only those costs that are directly associated with the manufacturing process are deducted.

On the other hand, the net profit is the residual income that an organization gets after deducting all the deducting all the expenses that an organization incurs during the production period of a certain year or financial period. All the direct and indirect expenses must be deducted for the entity to realize its net profits.

2) Objective of Gross Profit and Net Profit

The second difference is that the two profit concepts are differentiated by their objectivity.

The management of the organization calculates the gross profit to determine the rough estimate of the company’s profitability. Moreover, the entity may also calculate the net profits to determine operational efficiency and its ability to convert finished goods into sales.

On the other hand, net profit is the actual profit that an organization gets after deducting all the expenses. The net profit of the company is used in determining the profitability of the organization, which can sometimes be a loss. The objective of calculating net profit is to determine whether the company is profitable or not.

3) Purpose/Function of Gross Profit and Net Profit

The third difference between gross profits and net profits arises from the purpose or their functions.

Accounting departments of an organization calculate gross profits so that they can understand the impact of the manufacturing costs on the profits of the company. The company thereby controls the excess manufacturing costs so that it can ensure that it gets maximum profits while at the same time using minimum expenses.

On the other hand, organizations calculate net profit to determine the performance of the company in a specific financial year. Calculating the net profit can also be used as a strategy for determining whether the investment is worth or has a shorter payback period.

4) Reliability/Realistic of Gross Profit and Net Profit

The other difference that individuals should understand is that gross profit is not the true profit of the company and should not be relied upon in making decisions concerning the future of the company.

Gross profit is calculated after deducting only the manufacturing costs ignoring other expenses, taxes, and interests on loans. This means that this type of profit is not realistic.

On the other hand, net profits are the true profits of the organization and the management of the organization can use this type of profits to make future decisions about the development of the company. When calculating net profits, all types of cash outflow are deducted which gives the true and realistic picture of the performance of the company.

5) Credit Balance in Gross Profit and Net Profit

The two terms are also used differently in showing the credit balance of the organization.

The gross profit of an entity is significantly used in showing the credit balance of the trading account. This means that gross profit is the balance between the components that the organization has bought and those that it has sold.

On the other hand, the net profit of the business is used to show the credit balance of the profit and loss account. The net profit would appear as either profit or loss of the organization depending on which is higher between the income and the total expenses of the company together with taxes and interests on loans. This means that the two types of profits appear in different financial statements.

6) Progress and Profitability of Gross Profit and Net Profit

Finally, gross profit and net profit are differentiated by the fact that gross profits are used to show the progress of the business and can be judged by comparing the gross profits and the net sales.

On the other hand, net sales are used to show the profitability of the company and can be judged by comparing the net profits with the net sales.

Difference Between Gross Profit and Net Profit

Summary of Gross Profit vs. Net Profit

- Knowing the distinction between gross profits and net profits is essential and helpful for the readers of the financial statement.

- Besides, it is vital for one to familiarize himself or herself with these terms because they are used in showing the profitability of the entity.

- Difference Between Gross NPA and Net NPA - April 20, 2018

- Difference Between Job Description and Job Specification - April 13, 2018

- Difference Between Yoga and Power Yoga - April 10, 2018

Search DifferenceBetween.net :

Leave a Response

References :

[0]Kalecki, Michal. "A theory of profits." The Economic Journal52.206/207 (1942): 258-267.

[1]Kenyon, George, Cem Canel, and Brian D. Neureuther. "The impact of lot-sizing on net profits and cycle times in the n-job, m-machine job shop with both discrete and batch processing." International Journal of Production Economics 97.3 (2005): 263-278.

[2]Redpath, Timothy, and Frank A. Corsini. "Simulated trading system with awards to participants based on portfolio net profits." U.S. Patent No. 7,359,876. 15 Apr. 2008.

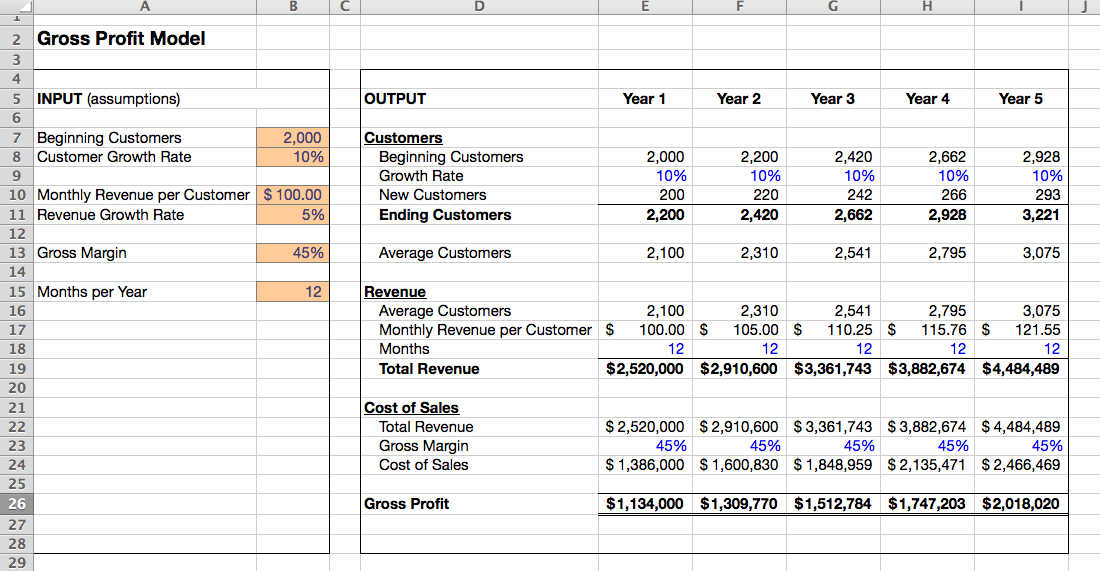

[3]Image Credit: https://commons.wikimedia.org/wiki/File:Simple_Financial_Model.png#/media/File:Simple_Financial_Model.png

[4]Image Credit: https://www.flickr.com/photos/sampjb/7690685382