Difference Between Merger and Tender Offer

Running a business has its perks and downsides. While a business can opt to struggle or thrive on its own, there are many options that can be undertaken to ensure smooth business continuity. Some of these options include acquisitions, mergers, tender offers, and even conversions. The option to be carried out depends on the advantages a business may enjoy through a certain process, and also potential business ownership changes. Mergers and tender offers may be commonly confused but have various differences.

What is Merger?

This is a corporate combination of two or more corporations into a single business enterprise. In most cases, mergers occur through the absorption of a firm by the dominant one. It may be done either through the purchase of assets, stock, assets in exchange for the shares in the firm acquired. Mergers may be created for several reasons such as;

- Eliminating competition

- Diversify the products and services

- Reduce expenses

- Uptake an advantage from a firm, such as financial and technical expertise

Types of mergers

- Horizontal merger- A horizontal merger occurs when two firms in the same line of business such that they offer the same products and services become one. They come hand in hand to utilize economies of scale and at the same time increasing market share.

- Vertical mergers- This is a business merger between companies that are in the same supply chain. The aim of this is to have quality control and a good channel of information flow in the firm.

- Market extension mergers- This is a merger between companies that operate in the same market but sell different products and services. This type of a merger expands the market thus a larger client base.

- Product extension mergers- This is a merger between companies that operate in the same market but sell related services and products. This expands the client base and also utilizes the same distribution channels.

- Conglomerate mergers- This is a scenario whereby companies that offer unrelated services or products merge. This merger poses a risk as there is immediate shift in the respective business operations as both companies operate in unrelated markets.

What is Tender Offer?

This is an offer by a public traded firm to the shareholders to purchase company’s securities within a certain period of time. Tender offers are open for a limited period of time, whereby potential bidders are invited to make a bid.

Various types of tender offers include;

- Mandatory tender offers- This is a scenario whereby the company making an offer has to make the tender offers for reasons such as voting rights in AGSs.

- Voluntary tender offers- This is a voluntary move by a firm to make tender offers.

- Friendly tender offers- This is a tender offer that has been recommended and accepted by the board of directors.

- Hostile tender offer- This is a decision to make tender offers without informing the board of directors.

- Creeping tender offer- The aim of this is to acquire enough shares in the company mainly for voting rights.

- Exclusionary tender- This is a purchase of company shares from some shareholders while excluding others, and is hence prohibited.

- Two-tier- In this tender offer, the company first obtains voting rights and purchases the rest of the shares in the second stage.

- Self-tender/ Buy-back offer – This is an offer to the shareholders whereby the company purchases back the shares after some time.

- Partial tender offer- This is an offer to purchase only a part of the shares.

Similarities between Mergers and Tender Offers

- In both, decision making is split between two or more parties

- Both enjoy advantages such as sharing of risks and access of additional financial resources

Differences between Mergers and Tender Offers

Definition of Mergers and Tender Offers

A merger is a corporate combination of two or more corporations into a single business enterprise. On the other hand, a tender offer is an offer by a public traded firm to the shareholders to purchase company’s securities within a certain period of time.

Title

In a merger, a new business name may be acquired. On the other hand, in a tender offer, a new business name is not acquired.

Terms of Mergers vs. Tender Offers

While a merger involves friendly terms of carrying business, a tender offer may involve friendly or hostile terms.

Purpose

The purpose of a merger is to eliminating competition, diversify the products and services and reduce operating expenses. On the other hand, the purpose of a tender offer is to acquire premiums from the sale of the offers.

New entity

In a merger, a new business entity is formed. On the other hand, a tender offer does not involve the formation of a new business entity.

Ownership

In a merger, the ownership of a company changes. On the other hand, although the shareholders may change due to a tender offer, company ownership does not change.

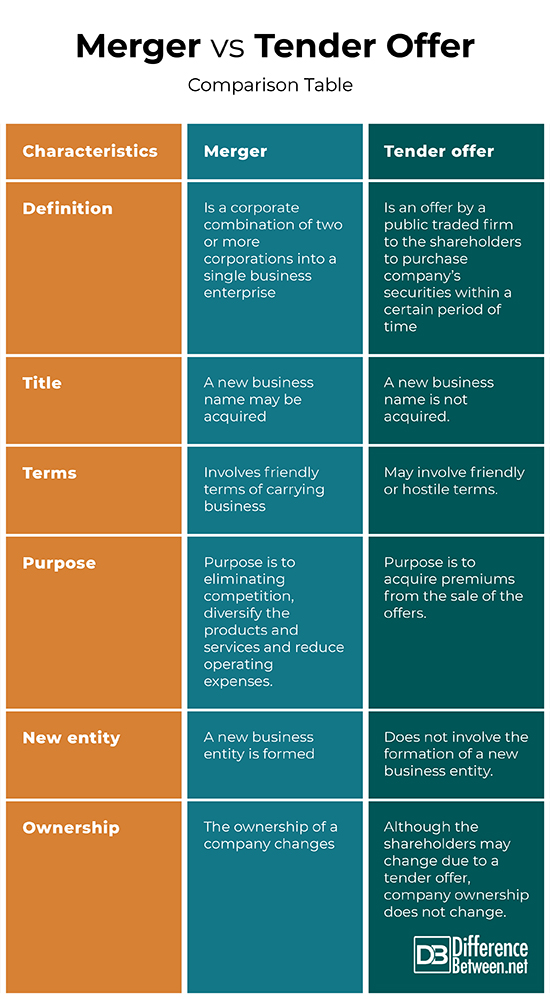

Merger vs. Tender Offer: Comparison Table

Summary of Merger vs. Tender Offer

While a merger is a corporate combination of two or more corporations into a single business enterprise whereby a firm is absorbed by the dominant in most cases, a tender offer is an offer by a public traded firm to the shareholders to purchase company’s securities within a certain period of time, usually over a limited period of time.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]Kirchner Thomas. Merger Arbitrage: How to Profit from Global Event-Driven Arbitrage. John Wiley & Sons Publishers, 2016. https://books.google.co.ke/books?id=kGXwCwAAQBAJ&pg=PA188&dq=Difference+between+mergers+and+tender+offer&hl=en&sa=X&ved=0ahUKEwihnrS76v_gAhXv1uAKHZkIBO4Q6AEIKDAA#v=onepage&q=Difference%20between%20mergers%20and%20tender%20offer&f=false

[1]Eckbo Espen. Takeover Activity, Valuation Estimates and Merger Gains: Modern Empirical Developments. Academic Press Publishers, 2010. https://books.google.co.ke/books?id=fsq6x6plIIQC&pg=PA28&dq=Difference+between+mergers+and+tender+offer&hl=en&sa=X&ved=0ahUKEwihnrS76v_gAhXv1uAKHZkIBO4Q6AEILjAB#v=onepage&q=Difference%20between%20mergers%20and%20tender%20offer&f=false

[2]Frensch Florian. The Social Side of Mergers and Acquisitions: Cooperation relationships after mergers and acquisitions. Springer Science & Business Media Publishers, 2007. https://books.google.co.ke/books?id=ULoaiAAXc6MC&pg=PA98&dq=Difference+between+mergers+and+tender+offer&hl=en&sa=X&ved=0ahUKEwihnrS76v_gAhXv1uAKHZkIBO4Q6AEIQDAE#v=onepage&q=Difference%20between%20mergers%20and%20tender%20offer&f=false

[3]Image credit: https://pixabay.com/illustrations/competition-business-offer-sale-2064865/

[4]Image credit: http://www.thebluediamondgallery.com/handwriting/m/merger.html