Difference Between Consumer Price Index and Inflation

Tracking how everyone spends their money is difficult. However, it is possible to get the average amount that every household spends and the buying pattern. Why is this important, you may ask? The consumer price index is used as a measure of inflation. It is also used by employers to measure the cost of living and make adjustments in salaries and wages. The Canadian government as well uses the consumer price index to adjust social benefits and income taxes. But what is the variance between the Consumer Price Index and inflation? Let’s see below.

Consumer Price Index

The Consumer Price Index (CPI) is a measure of changes that consumers experience in prices by comparing the cost of fixed services and goods time. The measure of CPI involves 8 major components which include shelter, food, furnishings and equipment, household operations, transportation, clothing and footwear, recreation and health and personal care.

Computed quarterly or monthly, the Consumer Price Index is based on the expenditure of people of all ages. To calculate the Consumer Price Index, the cost of the market basket in the given year is divided by the cost of the market basket in the base year.

What are the uses of the Consumer Price Index?

- It is used to adjust the prices of other economic indicators. For instance, the Consumer Price Index measures the inflation that end-users face. It also determines the purchasing power of the dollar as well as measuring the effectiveness of economic policies that have been put in place.

- It is a measure of living adjustment costs for social security beneficiaries and wage earners. It is also used as a preventive measure for tax rate increases due to inflation.

- It is used to measure other economic indicators such as national income components.

What are the limitations of the Consumer Price Index?

- It does not apply to all population groups. For instance, CPI that represents urban settings may not be suitable for rural settings. For instance, CPI in Canada is measured in each territory and province. If say, the CPI in Ontario is 39.83%, this percentage shows that the consumption in Ontario is 39.83% of the household consumer spending in Canada.

- It cannot be used to compare two areas since a higher CPI is not always an indication of higher prices.

- It does not give official estimates for population subgroups

- CPI only measures the cost t of living and does not measure all aspects that affect living standards

- CPI is marred by various limitations such as non-sampling errors, sampling errors and the fact that it excludes energy costs

Inflation

Inflation is the decrease in the value of a given currency over time. Inflation can be estimated at the rate at which a basket of selected goods or the average price level declines over time. Often expressed as a percentage, inflation means that a given unit of currency can only purchase less compared to the previous periods.

What are the causes of inflation?

When the supply of money increases, inflation is often inevitable. In some cases, monetary authorities can increase the supply of money by giving more money to people or printing more money. This only devalues the currency, meaning that people will need more money to make purchases. When the supply of money increases, it loses its purchasing power.

There are three types of inflation:

- Demand-pull effect- Demand-pull inflation arises when there is a rise in the supply of money and credit. This results in an increase in the demand for services and goods in an economy over the production capacity of an economy. The rise in demand results in an increase in prices.

- Built-in inflation- This is a type of inflation that is adaptive to people’s expectations. When there is inflation in an economy, people expect the current inflation to continue. As such, as the prices of services and goods increase, people expect that they will continue paying the high amounts. The result is a demand for higher wages to maintain their normal living standards. When wages are increased, the result is a higher cost of services and goods.

- Cost-push effect- This is inflation that occurs through a rise in prices through the inputs used in the production process. This causes an increase in the cost of the finished service or product. For instance, the rise in the cost of raw materials such as oil prices increases the consumer prices.

The most commonly used inflation indices include the Consumer Price Index and the Wholesale Price Index.

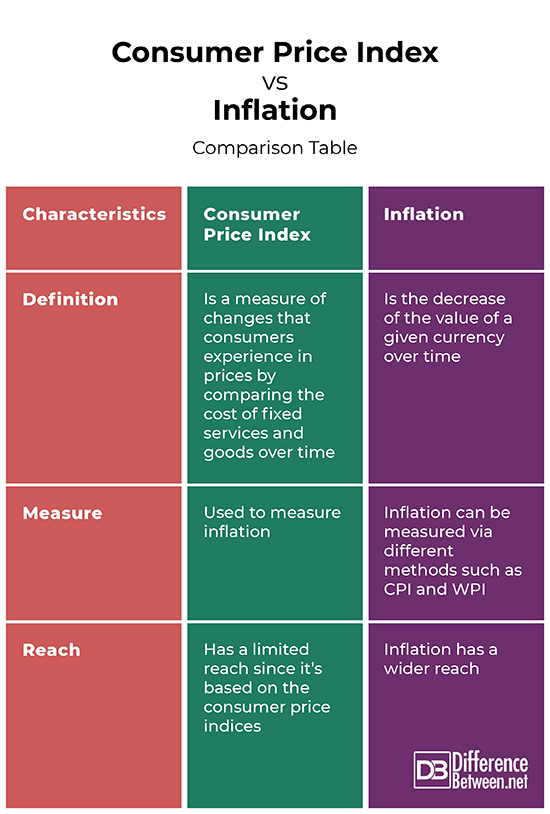

Differences between Consumer Price Index and Inflation

Definition

Consumer Price Index is a measure of changes that consumers experience in prices by comparing the cost of fixed services and goods over time. On the other hand, inflation is the decrease of the value of a given currency over time.

Measure

CPI is used to measure inflation. On the other hand, inflation can be measured via different methods such as CPI and WPI.

Reach

CPI has a limited reach since it’s based on the consumer price indices. On the other hand, inflation has a wider reach.

Consumer Price Index vs. Inflation: Comparison Table

Summary of Consumer Price Index vs. Inflation

Consumer Price Index is a measure of changes that consumers experience in prices by comparing the cost of fixed services and goods over time. On the other hand, inflation is the decrease of the value of a given currency over time. CPI is one of the methods used to measure inflation.

FAQs

Is the Consumer Price Index the same as inflation?

No. The Consumer Price Index is one of the methods used to measure inflation.

What is the relation between CPI and inflation?

Both are used to measure the changes in consumer prices, with CPI being the main measure of inflation.

Is CPI the best measure of inflation?

Yes. CPI is the best measure of inflation.

How is food inflation different from Consumer Price Index?

Food inflation measures the rise in the costs of food items while CPI only measures price changes in selected consumer products.

- Difference Between Profit Center and Investment Center - July 2, 2022

- Difference Between Anti-Trust and Anti-Competition - June 6, 2022

- Difference Between Stocktaking and Stock Control - June 6, 2022

Search DifferenceBetween.net :

Leave a Response

References :

[0]International Labour Office, International Monetary Fund, OECD, The World Bank, The United Nations Economic Commission for Europe, Statistical Office of the European Communities, Luxembourg. Consumer Price Index Manual: Theory and Practice. International Labour Organization, 2004. https://books.google.co.ke/books?id=uYQeQH_hsFgC&printsec=frontcover&dq=Difference+between+consumer+price+index+and+inflation&hl=en&sa=X&ved=2ahUKEwi_wtKF7ef0AhUYDWMBHWFUAn0Q6AF6BAgHEAI#v=onepage&q=Difference%20between%20consumer%20price%20index%20and%20inflation&f=false

[1]United States. Congress. Senate. Advisory Commission to Study the Consumer Price Index. Toward a More Accurate Measure of the Cost of Living: Final Report to the Senate Finance Committee. The University of Michigan, 2013. https://books.google.co.ke/books?id=z3ZcDKbLNQ8C&printsec=frontcover&dq=Difference+between+consumer+price+index+and+inflation&hl=en&sa=X&ved=2ahUKEwi_wtKF7ef0AhUYDWMBHWFUAn0Q6AF6BAgJEAI#v=onepage&q=Difference%20between%20consumer%20price%20index%20and%20inflation&f=false

[2]Peter J N Sinclair. Inflation Expectations. Routledge, 2009. https://books.google.co.ke/books?id=7LWLAgAAQBAJ&printsec=frontcover&dq=Difference+between+consumer+price+index+and+inflation&hl=en&sa=X&ved=2ahUKEwi_wtKF7ef0AhUYDWMBHWFUAn0Q6AF6BAgGEAI#v=onepage&q=Difference%20between%20consumer%20price%20index%20and%20inflation&f=false